How to Save Money as a Teenager for a Car (Because Let’s Be Real, Driving is Awesome)

Alright, let’s talk about saving money. I know, I know, it’s not the most exciting topic, but trust me, it’s way more fun when you’re saving for something you REALLY want. And what’s cooler than a car? (Okay, maybe a concert ticket to see your favorite band, but still!)

So, you’re dreaming of hitting the road in your own ride, and you’re ready to start saving. Good for you! You’re already ahead of the game. But how do you actually make this happen? Let’s break it down, step by step, and make saving for a car less of a chore and more like a fun journey!

1. Figure Out How Much You Need (Because Money Doesn’t Grow on Trees, Right?)

First things first, let’s get real about how much you’ll actually need. Do some research on the type of car you want. Think about what features are important to you: safety, fuel efficiency, or maybe just a sweet sound system? Once you have a general idea, check out prices online and at dealerships.

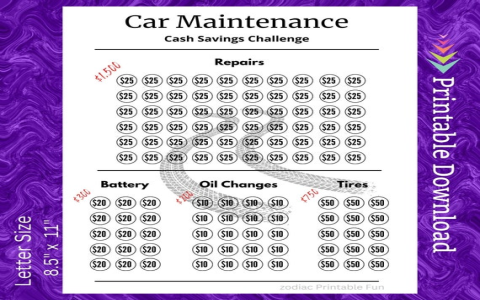

Remember, the price of a car is just the beginning. You’ll also need to factor in costs like insurance, registration, and maybe even some repairs down the line.

Here’s a simple breakdown to help you get started:

| Expense | Estimated Cost |

|---|---|

| Car Purchase | $5,000 – $15,000 |

| Insurance | $100 – $300 per month |

| Registration | $100 – $200 per year |

| Maintenance/Repairs | $200 – $500 per year |

This is just a rough estimate, so be sure to do some research and talk to your parents or a financial advisor to get a more accurate idea of the costs involved.

2. Make a Budget (Like, Seriously, Make a Budget)

Now that you know how much you need, it’s time to get serious about your budget. This is where you figure out how much money you can realistically save each month.

Think about your sources of income. Do you have a part-time job, receive an allowance, or maybe even get paid for doing chores? Write down all of your income sources and their average monthly earnings.

Next, list all of your expenses. This might include things like:

Essential expenses: These are the things you have to pay for, like food, shelter, and basic clothing.

Non-essential expenses: This is where things like entertainment, hobbies, and social activities fall.

Now, take a look at your expenses and see if there’s room to trim some fat. Can you cut back on your streaming subscriptions? Maybe you can try making your own lunch instead of buying it every day. Even small cuts can make a big difference over time!

Example:

Let’s say you earn $250 a month from your part-time job. You spend $50 on food, $50 on entertainment, and $50 on miscellaneous expenses. That leaves you with $100 to save. Not bad!

3. Find Creative Ways to Earn Extra Money (Because Who Doesn’t Love a Little Side Hustle?)

Saving is great, but earning more is even better! Look for opportunities to make extra money:

Offer your skills: If you’re good at something, like tutoring or graphic design, try offering your skills to others.

Do odd jobs: Check out online platforms or community boards for odd jobs like yard work or pet sitting.

Sell unwanted items: Have a closet full of clothes you never wear? Sell them online!

Don’t underestimate the power of small, consistent income streams. Every bit counts!

4. Be Smart With Your Money (Because It’s Your Hard-Earned Cash!)

Once you’ve earned some money, it’s time to be smart about how you spend it. Here are a few tips:

Track your spending: Use a budgeting app or a simple spreadsheet to track where your money is going. This will help you stay on track and see if there are any areas where you can save more.

Avoid impulsive buys: Think before you buy anything. Ask yourself if you really need it or if it’s just a temporary want.

Shop around for deals: Look for sales and discounts, especially for things you need often, like clothes or groceries.

Use cash instead of credit: Credit cards can make it easy to overspend, so try using cash for everyday purchases to stay on budget.

5. Find a Safe Place to Save Your Money (Because Nobody Wants to Lose Their Savings!)

Now that you’re earning and saving money, you need a safe place to keep it. Consider these options:

Savings account: This is a traditional option that offers a small amount of interest.

High-yield savings account: These accounts offer a higher interest rate, which can help your money grow faster.

Money market account: This account offers a bit more flexibility than a savings account, allowing you to withdraw money more easily.

Talk to your parents about opening a bank account for your savings. They can also help you understand the different account options and choose the one that’s best for you.

6. Set Realistic Goals and Celebrate Your Progress (Because Saving Money Is a Marathon, Not a Sprint!)

It’s important to set realistic goals for yourself and celebrate your progress along the way. Don’t expect to save enough for a car overnight.

Here’s a fun idea:

Visualize your goal: Create a vision board with pictures of the car you want, or even write down the exact amount you need to save. This will keep you motivated!

Break it down: Instead of focusing on the total amount, think about how much you need to save each month to reach your goal.

Celebrate milestones: Reward yourself for reaching smaller goals, like saving $500 or $1,000. This will help you stay motivated and on track.

7. Seek Guidance (Because You Don’t Have to Go It Alone!)

Don’t be afraid to ask for help! Talk to your parents, teachers, or even a financial advisor for tips and guidance. They can offer valuable advice and help you make informed decisions.

Keep Your Eye on the Prize (And Remember, Driving Your Own Car Will Be Totally Worth It!)

Saving for a car might seem like a long and difficult journey, but remember, it’s all about setting your goals, taking action, and staying consistent. And trust me, when you finally hit the road in your own ride, all those sacrifices will be worth it!

Now, tell me, what kind of car are you dreaming of driving? And what are some of your favorite ways to save money? Share your thoughts in the comments below!