Well, let me tell ya, this here money stuff, it ain’t as easy as pickin’ berries off a bush. I heard some folks talkin’ ’bout somethin’ called “sett lout of money covered call options NVDA”. Sounds like a mouthful, don’t it?

Now, I ain’t no fancy banker, but I’ve been around the block a few times. This NVDA, seems like it’s some kinda stock, like them things folks buy hopin’ they’ll grow like a prize-winnin’ pumpkin. And these “covered call options”, well, that’s where things get a bit fuzzy.

What’s this NVDA Thing Anyway?

From what I gather, this NVDA is a company, makes somethin’ for them computers. I don’t know much ’bout them machines, but I reckon if people are buyin’ it, it must be worth somethin’. Like when everyone wanted them Beanie Babies, remember that? This NVDA, it’s probably like that, but for grown-ups with money to spend.

So, you can buy a piece of this NVDA, like ownin’ a tiny slice of a big ol’ pie. And if this NVDA does good, makes lots of money, your little slice gets bigger too. That’s what they call a “stock”, I think.

This Covered Call Thing, What’s That About?

Now, this “covered call” thing, it’s like bettin’ on your prize-winnin’ hog at the county fair. You already own the hog, that’s the “covered” part. And you’re lettin’ someone else say, “I bet that hog won’t weigh more than a certain amount.” That’s the “call” part. If they right and they buy this “call”, then you get some cash for sellin’ the call to them. If they’re wrong, you just keep on keepin’ on.

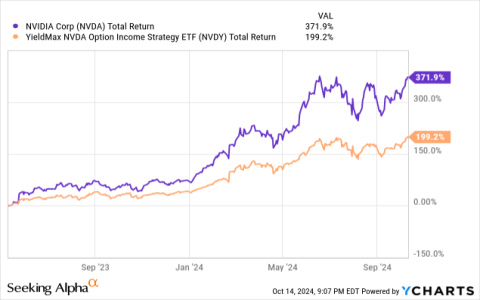

But here’s the catch, if that hog puts on a ton of weight, more than what they guessed, you still gotta sell it to ’em for the price you agreed on before. You miss out on some extra money, but hey, you still got somethin’ for that hog. It’s like a safety net, I guess, so you don’t lose your shirt if things go south, but it’s also like a rope around your neck if things go well.

- You sell a “call” on some stock you own – that is called a “covered call”.

- That means you make money on the “call”, but you got to sell the stock at a price you set before, no matter how high the price gets.

- You can make a bit of money this way. It is like a bet.

Why Bother with This Covered Call Mumbo Jumbo?

Well, some folks, they like a little extra cash. And sellin’ these covered calls, it’s like sellin’ eggs from your hen. You get a little somethin’ every now and then. It ain’t much, but it adds up. Like findin’ a dollar in your old coat pocket.

Plus, it’s like I said, a safety net. If that NVDA stock suddenly drops like a sack of potatoes, you still got that little bit of money from sellin’ the call. It won’t make you rich, but it’s better than nothin’.

But you gotta be careful, see? If that NVDA stock goes way up, higher than a kite in a hurricane, you’re gonna be kickin’ yourself for sellin’ that call. You coulda made a lot more money, but you already promised to sell it for less. Them calls you sold will take a bite out of your stock. It will sting, I tell ya.

So, is This Covered Call Thing Right for Me?

Well, that’s for you to decide, honey. It’s like choosin’ between a sure thing and a gamble. Do you want a little bit of money now, or do you wanna risk it for a chance at a whole lot more later?

If you’re like me, and you like to play it safe, maybe this covered call thing ain’t so bad. It is a safe way to make some money on your NVDA stock. It’s like gettin’ paid to wait. But if you’re a young whippersnapper with a fire in your belly, maybe you wanna let that NVDA stock run wild and see how high it can go.

Just remember, there ain’t no guarantees in this life. Except maybe death and taxes. And that the sun will come up tomorrow. So, whatever you decide, make sure you know what you’re gettin’ yourself into, and for goodness sake don’t sell your call too cheap.

This “sett lout of money covered call options NVDA” thing, it’s just another way to try and make a buck in this crazy world. It ain’t easy, but nothin’ worth havin’ ever is. It is a good way to maybe make some money, but you got to be careful. You got to know how things work.

This “sett lout of money” means you are sellin’ a call that is above what the stock price is now. That way, if the price goes up, you make money on your NVDA stock, and on the call. It is a good way to make money if you think the price will go up just a little bit.

This covered call will give you some money when you sell it, and that will help if the price of NVDA goes down. It is a little bit of safety, I guess. I hope you know what you are doin’ with your money. I am just an old lady, but I know a little bit about money, I guess.