Okay, so let me tell you about this thing I started calling my “money table”. It wasn’t anything fancy, really started out of pure necessity, you know? Things got a bit tight a while back, not like dire straits, but enough that I realized I had no clue where my cash was actually going each month. It felt like I was just winging it, and honestly, that started to stress me out. Couldn’t keep track of bills, savings, random spending. It was a mess.

Getting Started – The Why

So, I figured I had to do something. Couldn’t just keep guessing. I remembered my dad used to have this little notebook, scribbling down numbers. Kinda old school, right? But the idea stuck. I needed a system, my system. Not some complicated app that wants all my bank details, just something straightforward I could manage myself.

The First Attempt – Pen and Paper Chaos

First, I literally grabbed a notebook, just like my dad. Drew some columns: Date, What I Bought, How Much. Simple. But yeah, that lasted about a week. It got messy fast. My handwriting’s terrible for starters. Plus, adding things up was a pain, and I kept losing the darn notebook. It just wasn’t practical for me, always on the move.

Moving to Digital – Spreadsheet Time

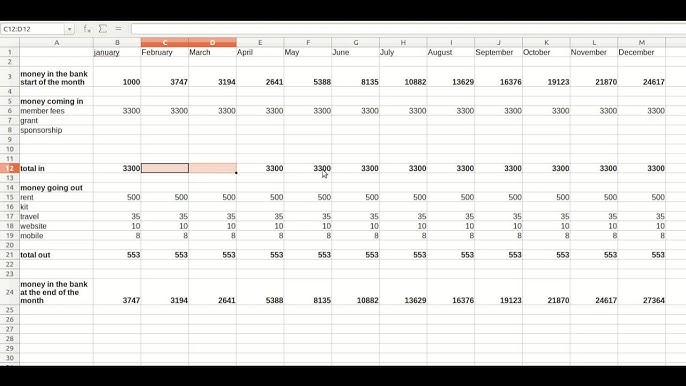

Alright, plan B. I decided to use the computer. Fired up a basic spreadsheet program – you know, the one everyone has. No fancy software needed. I thought, okay, let’s make this make sense. I needed more detail than just “stuff I bought”.

So, I started setting up columns:

- Date: Obvious one.

- Description: What exactly did I spend on or earn? Like ‘Groceries’, ‘Gas’, ‘Paycheck’, ‘Coffee Shop’.

- Category: This was key. I made broad categories like ‘Food’, ‘Transport’, ‘Bills’, ‘Income’, ‘Fun Money’, ‘Savings’. Made it easier to see patterns later.

- Income: A column just for money coming in.

- Expense: A column just for money going out.

I put the most recent stuff at the top, so it was easy to add new things each day or every couple of days. Didn’t want it to become a huge chore I’d avoid.

Making it Work – Formulas are Friends

The best part of the spreadsheet was the automatic math. I’m no genius with formulas, but I figured out the basics. At the bottom, I added totals for the Income and Expense columns. Then, a big, simple calculation: Total Income – Total Expense = What’s Left. Seeing that number, clear as day, was a game-changer.

I also set it up to calculate totals for each category. So, at the end of the month, I could see exactly how much went to ‘Food’ or ‘Fun Money’. That was eye-opening, let me tell ya. Seeing the ‘Fun Money’ total sometimes made me wince a bit, haha.

Tweaks and Changes

It wasn’t perfect right away. First few weeks, I kept realizing I needed more categories. Added things like ‘Household Stuff’, ‘Car Maintenance’, ‘Subscriptions’. I also played around with the layout a bit until it felt easy to scan quickly. Made the header row bold, maybe added some simple borders. Nothing crazy, just functional.

How it is Now – My Go-To Tool

So now, this “money table” is just part of my routine. Takes maybe five minutes every couple of days to update. I just pull up the file, punch in the latest transactions from receipts or my banking app. It’s not rocket science, but it works for me.

It doesn’t magically make me richer, obviously. But the stress? Mostly gone. I know what’s coming in, what’s going out, and I can actually plan. If I want to save for something specific, I can see where I might need to cut back. It’s just about being aware, you know? Taking control of that little piece of my life that used to feel kinda chaotic. And yeah, it’s just a simple spreadsheet, but building it myself and keeping it going? Feels pretty good.