Well, you wanna know how to figure out that money-weighted return thingy without using a calculator, huh? Ain’t no need to worry, ’cause it’s not as complicated as it sounds. I’m gonna break it down real simple for ya, like how we used to talk about things back in the day. So, here goes:

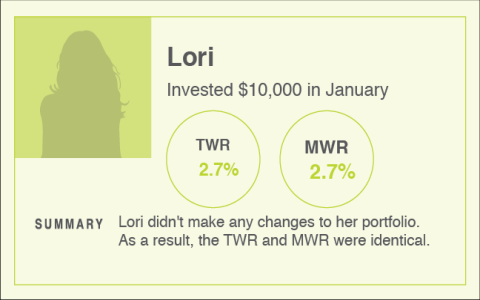

Now, let me tell ya first, when we’re talkin’ about money-weighted return, it’s all about how much money you put in and when you put it in. It takes into account all the cash you add or take out from your account, and that affects the return, ya see? It’s kinda like plantin’ seeds in a garden—you gotta think about when you planted them, how much water you gave ’em, and how long you let ’em grow before you pick the fruit. The longer you leave ’em, the better the harvest might be.

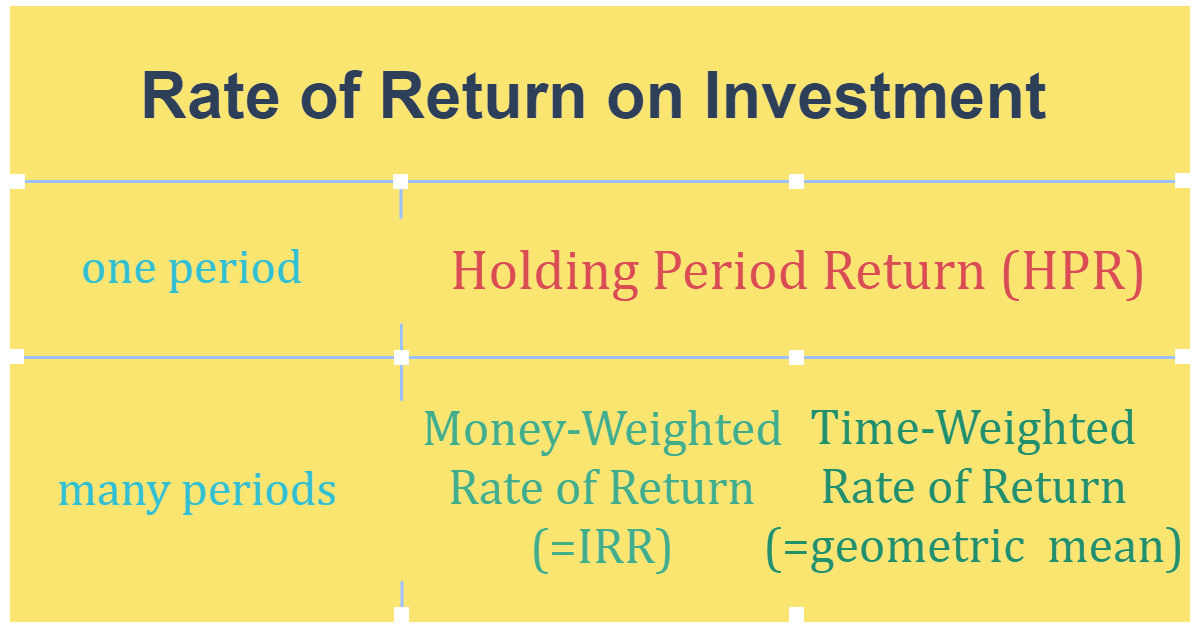

So, this here money-weighted return, or MWRR, is calculated just like that Internal Rate of Return, IRR, thing. I know, sounds fancy, but it ain’t all that bad. You start with your cash flows, like when you put in your money, and then you calculate how much it grows over time. But instead of using a calculator, you just gotta do a little bit of math and patience.

Let’s say you start off with $1,000, right? That’s your CF0 (cash flow at time zero). Then later on, you add or take out more money. Say you add another $500, that becomes your CF1. It’s kinda like when I used to save pennies in the jar and then add a few more each week to see it grow. Your MWRR helps you figure out how well your little jar of savings did over time.

One way to do this is to use that formula you hear about in finance books—IRR or Internal Rate of Return. But like I said, we’re gonna skip the fancy calculator and just think through it. You have to figure out what the rate is that’ll make all those cash flows balance out to zero. It’s like tryin’ to figure out when to take your money out so you don’t lose any of it, but still make a little somethin’ too. Ain’t that the goal?

So here’s the trick: you write down all your cash flows, every time you put money in or take money out. Then, you just gotta find that interest rate (the one that makes your money grow just enough to match all them changes). This ain’t somethin’ you can do in your head without the right tools, but with a bit of paper and patience, you can figure it out, just like I used to do with my knitting—slow but sure, ya know?

Now, most folks go the easy route and use Excel for this. They’ve got a formula in there called “IKV” that you can use to do the MWRR without a whole lot of fuss. But if you’re doin’ it by hand, well, it just takes some time. You lay out the cash flows, calculate each little return for each period, and keep adding it up.

If you wanna make things easier, here’s a little shortcut: just take each cash flow, and multiply it by the return for that period. Then, you keep doing this for all the periods until you get a final number that tells you what your return was. It’s a little like makin’ a stew, adding a bit of this and a bit of that until it tastes just right.

Here’s a quick example:

- First, you put in $1,000 (CF0).

- Then, a few months later, you put in another $500 (CF1).

- And over time, the return from those two amounts grows. Let’s say it grows by 10% each year.

- After a few years, you take some out, maybe $200 (CF2). Now you gotta calculate how that affects everything.

By the time you finish, you’ve figured out your money-weighted return. But it ain’t just about the numbers, it’s about how long you let the money sit there and what you did with it while it was growin’. Timing is key, just like planting the right seeds at the right time to get the best crop.

But, hey, I know that’s a lot of mumbo jumbo for some of y’all, and if you want to make it real easy, just hop on Excel and use the “IKV” function. That’ll get ya the right answer without all the extra thinking. But if you’re in the mood for some mental exercise, then grab your pencil and paper and get to work!

To wrap it up:

- The money-weighted return takes into account the timing of your cash flows.

- You calculate it like the IRR formula, which means you’re looking for the rate that makes all your cash flows balance out.

- If you don’t have a fancy calculator, you can do it by hand with patience and a bit of math.

- Excel’s the easy way to go, just use the IKV function.

So, there ya have it. Now you know how to figure out that money-weighted return without all the fancy gadgets. It’s all about knowin’ when to put in your money and when to take it out. Keep it simple, and you’ll be fine!

Tags:[Money Weighted Return, MWRR, calculate return, internal rate of return, IRR, financial calculations, Excel formula, timing of cash flows]