Okay, so I was trying to figure out this whole “cash raised vs. post-money” thing today. It’s one of those things you hear thrown around a lot in the startup world, but it can be a bit of a head-scratcher at first.

I started by doing some digging online, trying to get a basic understanding. A lot of what I found was full of jargon, but I think I finally cracked it. Basically, “cash raised” is the actual money a company gets from investors in a funding round.

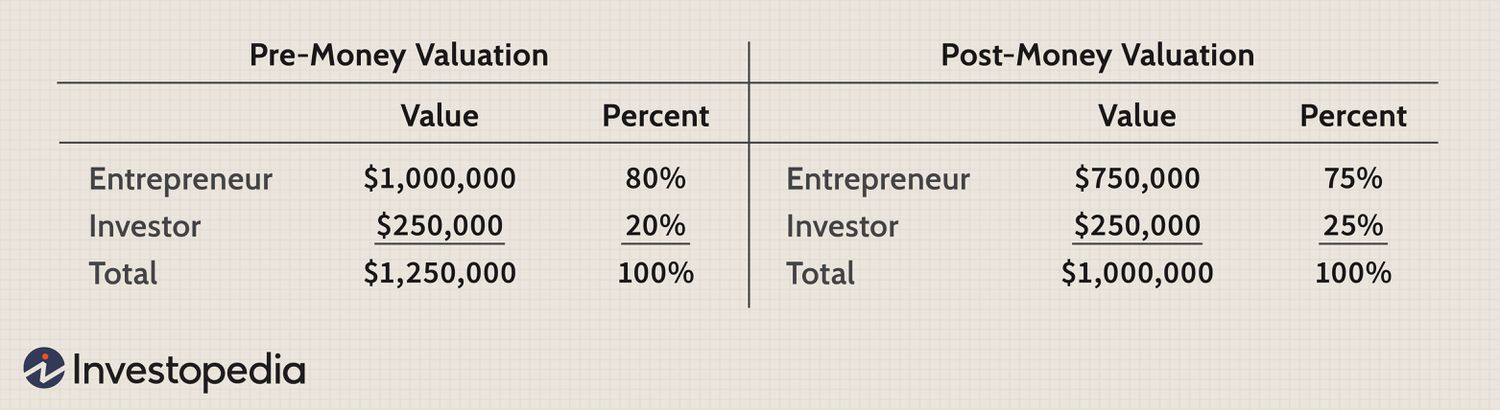

Then there’s this thing called “post-money valuation.” That’s just the company’s value after the investment. It’s like, the company was worth X before, then they got some money, and now they’re worth X plus the money.

I found this one explanation that said it’s calculated by adding the cash acquired to the pre-money valuation. That made it click for me. So, pre-money valuation is what the company is worth before the investment, and post-money is after. It’s all about timing.

I even read that cash raised is kind of like the fuel that helps a company grow. That’s a pretty good analogy, I think. It’s the money that lets them hire people, build products, and all that stuff.

So here is my conclusion:

- Cash Raised: The actual money a company gets from investors.

- Post-Money Valuation: The company’s total value after getting that investment.

- Pre-Money Valuation: The company’s value before the investment.

It took me a while, but I think I finally understand this stuff. At least, I’ve got a better handle on it than I did this morning! You know what, it is not that hard, just need to be clear about the words.