Okay, so let me tell you about my recent experience with this whole “Essential Healthcare Group” thing. It’s been a bit of a ride, I gotta say. I needed to get some health insurance stuff sorted out for myself, nothing too fancy, just the basic, must-have kind of deal. You know, the stuff that covers you if you suddenly find yourself in a hospital bed.

I started poking around online, just trying to figure out what my options were. There’s a ton of information out there, and honestly, it gets overwhelming pretty fast. You got your “Affordable Care Act,” your “EHBs,” and all these other terms flying around. I felt like I needed a degree in medical jargon just to understand it all.

Getting Started

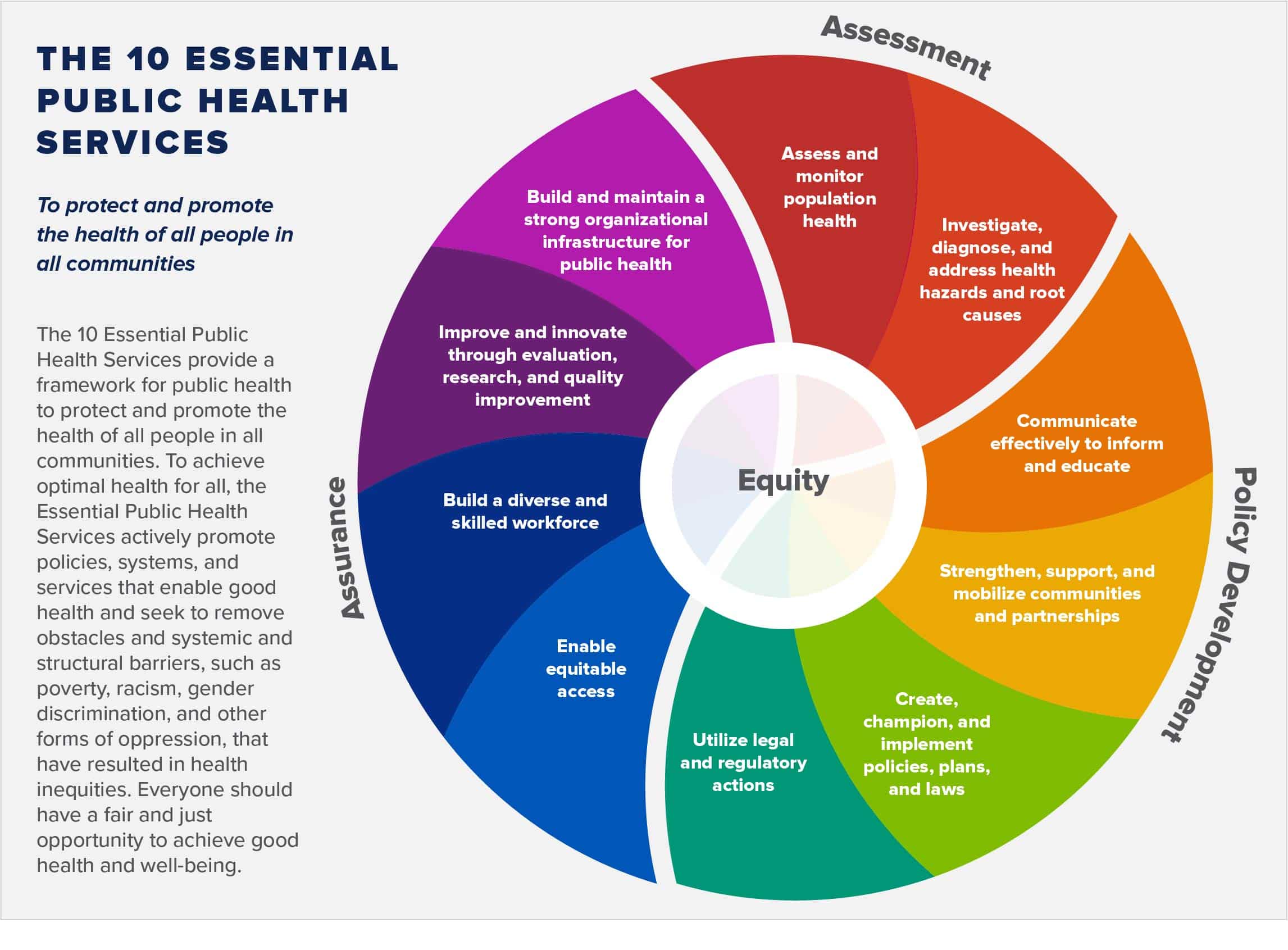

First thing I did was just try to understand what Essential Health Benefits (EHBs) actually are. Turns out, it’s basically a list of 10 things that all insurance plans in the individual and small group markets have to cover. Stuff like doctor visits, hospital stays, prescription drugs, and mental health services. It’s like a minimum safety net, which is cool, but it’s also just the starting point.

I started comparing different plans, looking at what each one offered. Some had lower monthly payments, but then you’d get hit with higher costs when you actually needed to use the insurance. Others had higher monthly payments, but they covered more stuff, and you wouldn’t have to pay as much out of pocket later. It’s all a balancing act, and it took me a while to figure out what worked best for my situation.

My Choice

- Checked out different insurance providers, each with their own set of plans.

- Compared premiums (the monthly payment), deductibles (what you pay before insurance kicks in), and copays (what you pay for each service).

- Read through the fine print of each plan to see what was actually covered and what wasn’t.

I ended up going with a plan that had a decent balance. It wasn’t the cheapest, but it covered a good range of services, and the deductibles and copays seemed reasonable. I figured it was better to pay a bit more each month and have peace of mind knowing I wouldn’t be bankrupted by a medical emergency. It seems to have “3Cs”: consistency, continuity, and coordination of patient care.

The whole process was definitely a learning experience. It’s not easy navigating the world of health insurance, especially with all the different plans and rules. But I feel like I made a good decision in the end. It’s important to have that safety net, and now I can focus on other things without worrying about what would happen if I got sick or injured.

So, yeah, that’s my story with the Essential Healthcare Group adventure. It wasn’t always smooth sailing, but I got through it. If you’re going through something similar, just take your time, do your research, and don’t be afraid to ask questions. It’s your health, and it’s worth getting it right.