Well, let me tell ya, when it comes to these intangible assets, it’s a bit of a tricky thing. Now, an intangible asset is something that ain’t got no physical form, like a patent or a trademark, but it still holds value. And when we’re talkin’ about FRS 102, it’s important to know that these intangible things ain’t gonna last forever, no matter how valuable they seem. They all gotta have a time when they’re no longer useful or no longer worth anything.

So, what’s the deal with the “maximum life” of these intangible things, you ask? Well, under FRS 102, the useful life of an intangible asset can’t go on forever. It’s like how an old cow might not be able to work in the field once it gets too old. If it’s a contract or a legal right that creates the intangible asset, the life of that asset can’t last longer than the rights themselves. In other words, if the legal rights run out, then the asset’s usefulness is gone too. But sometimes, businesses might only want to use these assets for a shorter time. Maybe they think they’ll get the most out of it in a few years, so they might shorten the period of use. But all this comes with rules.

Now, there’s one thing that you might not know, and that’s that in exceptional cases, the maximum life of these intangibles might be limited to 10 years. That’s right, even if you can’t figure out just how long an intangible thing will be useful, FRS 102 says you can’t go over 10 years. Ain’t no way around that. So, if you’re in a business and you’re dealin’ with these types of assets, you best be keepin’ track of how long you think it’ll last.

For example, let’s say you bought a patent for somethin’, or you have some kind of legal right that you paid for. You can’t just say, “Well, this patent’s gonna last forever.” Nope, that ain’t how it works. You have to decide how long you’re gonna use it, and in many cases, if you can’t figure out that time, the law says 10 years max. That’s the most you can stretch it.

Now, don’t be fooled, because under FRS 102, intangible assets like goodwill are also part of this. That’s that thing where a company buys another company and the price is higher than the value of the assets. But no matter how you look at it, you can’t just say these things last forever either. They gotta be amortized, meaning the value gets spread out over time, just like if you were payin’ off a loan. And for these types of assets, their life can’t be considered indefinite. You gotta set a time limit, and sometimes that’s 10 years.

In some cases, you might have trouble figuring out exactly how long these intangibles will last. Maybe it’s too hard to measure, or the situation is just too complicated. When that happens, the law still doesn’t let you off the hook. It says you can’t go beyond 10 years for the amortization period. And let me tell ya, if you’re in business and you got intangible assets, you better be real careful with that. It’s easy to forget or overlook, but you can’t just keep something on the books forever like it’s still worth a dime when it ain’t.

Also, I heard some folks out there used to think that if they couldn’t figure out a time limit, they could just call an intangible asset indefinite. Well, that ain’t allowed no more. You can’t do that with FRS 102. If you don’t have a reliable estimate, well, you gotta stick to that 10-year rule. No exceptions there. And that includes things like trademarks, patents, and even the goodwill of a business. All of them need to have a set period for amortization, and it can’t go beyond 10 years in cases where it can’t be reliably estimated.

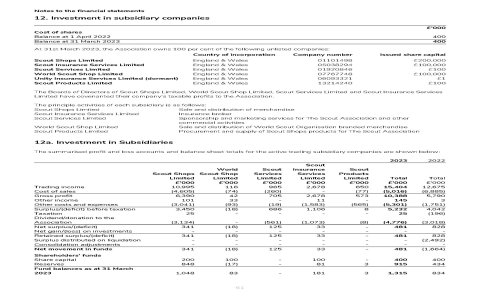

There’s also something else that’s important to remember. If you’re workin’ with a company that deals with these intangible assets, the company has to make sure they disclose how they’re dealing with these assets in their financial statements. This helps keep everything transparent and clear for investors or anyone else who needs to know. If you don’t, well, that could cause some problems later on.

So, in short, if you’re dealing with intangible assets under FRS 102, you gotta remember: these things can’t last forever. They got a set life, and you have to be able to figure out how long that is. If you can’t, then you’re looking at a maximum of 10 years. Simple as that. Don’t go thinking these things last forever, cause they don’t.

Tags:[FRS 102, Intangible Assets, Maximum Life, Amortization, Goodwill, UK GAAP, Accounting Standards]