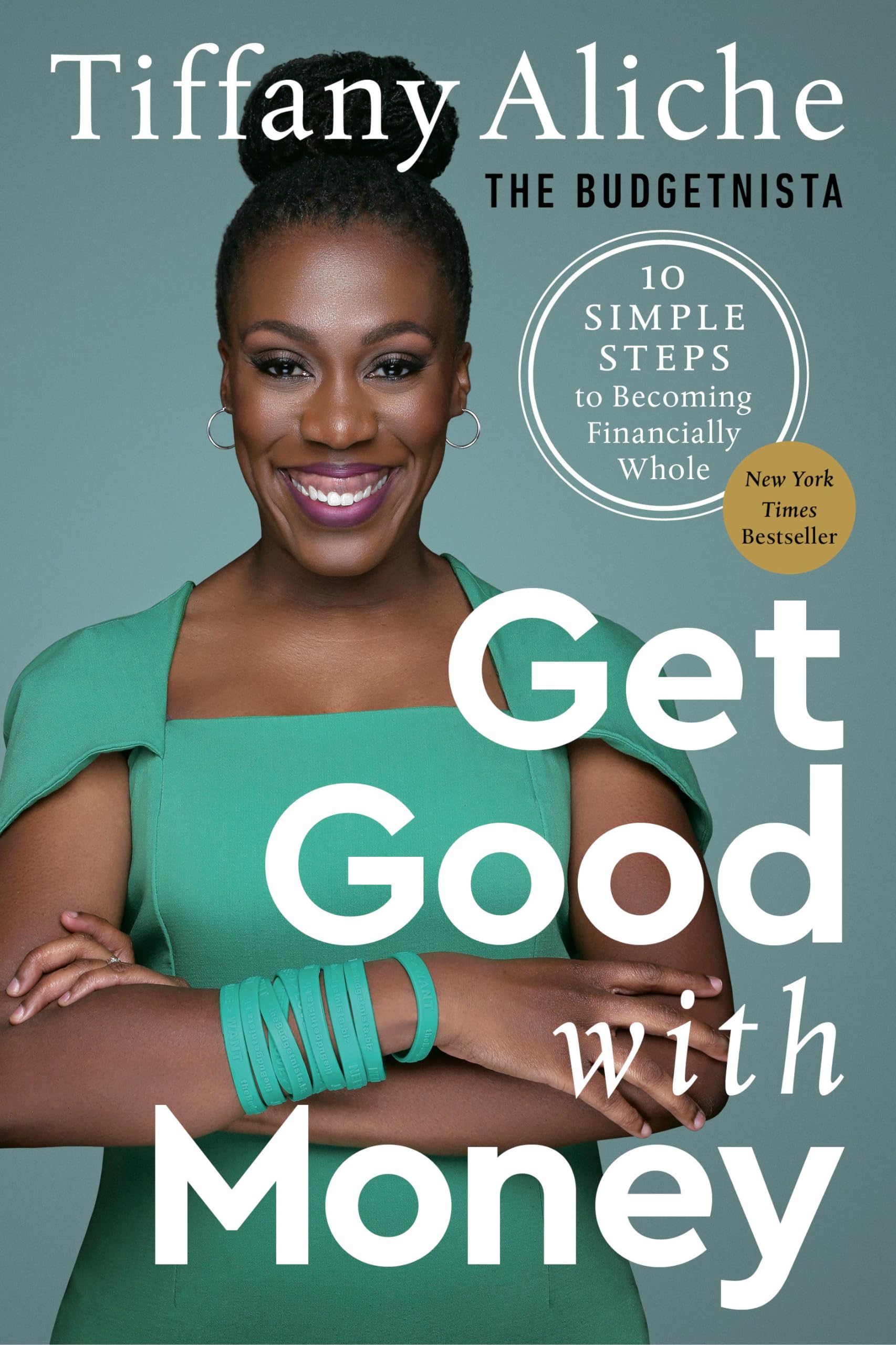

Well, let me tell ya, folks, if ya wanna get good with money, there ain’t no secret trick to it. It’s all about knucklin’ down, bein’ smart with what you got, and workin’ hard at it. Now, this ain’t somethin’ they teach ya in school, but there’s a lady named Tiffany Aliche, and she’s got a way of helpin’ folks just like you and me figure it out. She calls it “Get Good with Money,” and let me tell ya, it ain’t no magic, just a lotta good sense.

First thing I gotta say is this: before ya can get good with money, you gotta understand where it’s goin’. Now, I ain’t sayin’ that you have to be a math genius, but keepin’ track of your pennies is the first step. Tiffany, or as they call her, “The Budgetnista,” she’s a pro at helpin’ people get a hold of their finances, and she knows what she’s talkin’ about. This here book is like a guide to takin’ control of your money.

She breaks it down real simple with what she calls a “ten-step process.” Now, don’t get all nervous thinkin’ it’s some big complicated thing. It ain’t. It’s just ten steps to help ya put your money where it belongs, and more importantly, to stop it from runnin’ away from ya. The first step is all about knowin’ where your money is comin’ from and where it’s goin’. If you can’t track that, well, you’re just workin’ in the dark.

Once you get that under control, the next thing you gotta do is make sure you ain’t spendin’ more than what you got. I know it’s easy to get tempted, especially when you’re out buyin’ groceries or gettin’ something for the house, but trust me, it adds up. Tiffany’s advice here is to start puttin’ together a budget. It don’t gotta be fancy, just simple so you know what you can and can’t spend.

Here’s what I’ve learned from her:

- First, get a clear picture of your income and expenses.

- Then, cut back on unnecessary spendin’—if ya don’t need it, don’t buy it.

- Pay down those debts—don’t let them grow like a weed in the garden.

- Start savin’ for emergencies—things happen when you least expect it.

- Finally, invest in your future, even if it’s just a little bit at a time.

Now, I ain’t gonna sit here and tell ya that it’s all easy. Ain’t nothin’ in this life worth havin’ is easy. But like Tiffany says, if ya take it one step at a time, you’ll be amazed at what you can do. The big thing she teaches is financial wholeness—what she means by that is not just gettin’ your money in order today, but makin’ sure it’s ready for tomorrow, too.

Ya see, a lotta folks get caught up in just tryin’ to survive today. They get through the week or the month and don’t think about what happens after that. But when you work on gettin’ yourself financially whole, you’re thinkin’ about the long run. It’s about buildin’ somethin’ that lasts, somethin’ that’ll be there when you need it.

But here’s the thing—ya gotta start somewhere. Ain’t no use in wishin’ for money, ya gotta make it work for ya. Tiffany’s book tells ya how to set goals, how to save, and how to invest—no big fancy words, just plain ol’ advice that works. If you take these steps seriously, you’ll be set to build some real security in your life.

Now, another part Tiffany talks about is debt. Now, I know folks who are drownin’ in debt, and it’s tough to see how to climb out. But like she says, you gotta face it head-on. Don’t ignore it. The best way to get rid of debt is to make a plan—pay off the smallest ones first, and then work your way up. Ya might feel like it’s takin’ forever, but trust me, slow and steady wins the race.

What she teaches is simple, but it works:

- Start by payin’ off the little debts, then tackle the big ones.

- Cut back on anything that ain’t absolutely necessary.

- Set up a budget that works for you, and stick to it.

- Invest in your future—even a little can grow over time.

One thing Tiffany always says is that no matter where you start, you can get better with money. Don’t think you gotta be rich to make a difference in your finances. It don’t matter if you’re workin’ a regular job or livin’ paycheck to paycheck. If you’re smart with your money, you can make it work for you.

And let me tell ya somethin’ else, folks—Tiffany’s story is a reminder that anyone can turn things around. She didn’t start out with a ton of money. In fact, she had $85,000 in debt at one point! But she worked at it, bit by bit, and now she’s teachin’ folks all over the country how to get good with money. So, if she can do it, so can you!

So, if you’re lookin’ for a way to take control of your finances and make your money work for ya, I say pick up a copy of Tiffany Aliche’s book. It’s a real simple guide, but it’s got everything you need to start makin’ better decisions with your money. Ain’t no reason to wait, start today, and you’ll see the difference tomorrow.

Tags:[Get Good with Money, Budgeting, Financial Planning, Tiffany Aliche, Personal Finance, Wealth Building, Debt Management, Money Management, Save Money, Financial Security]