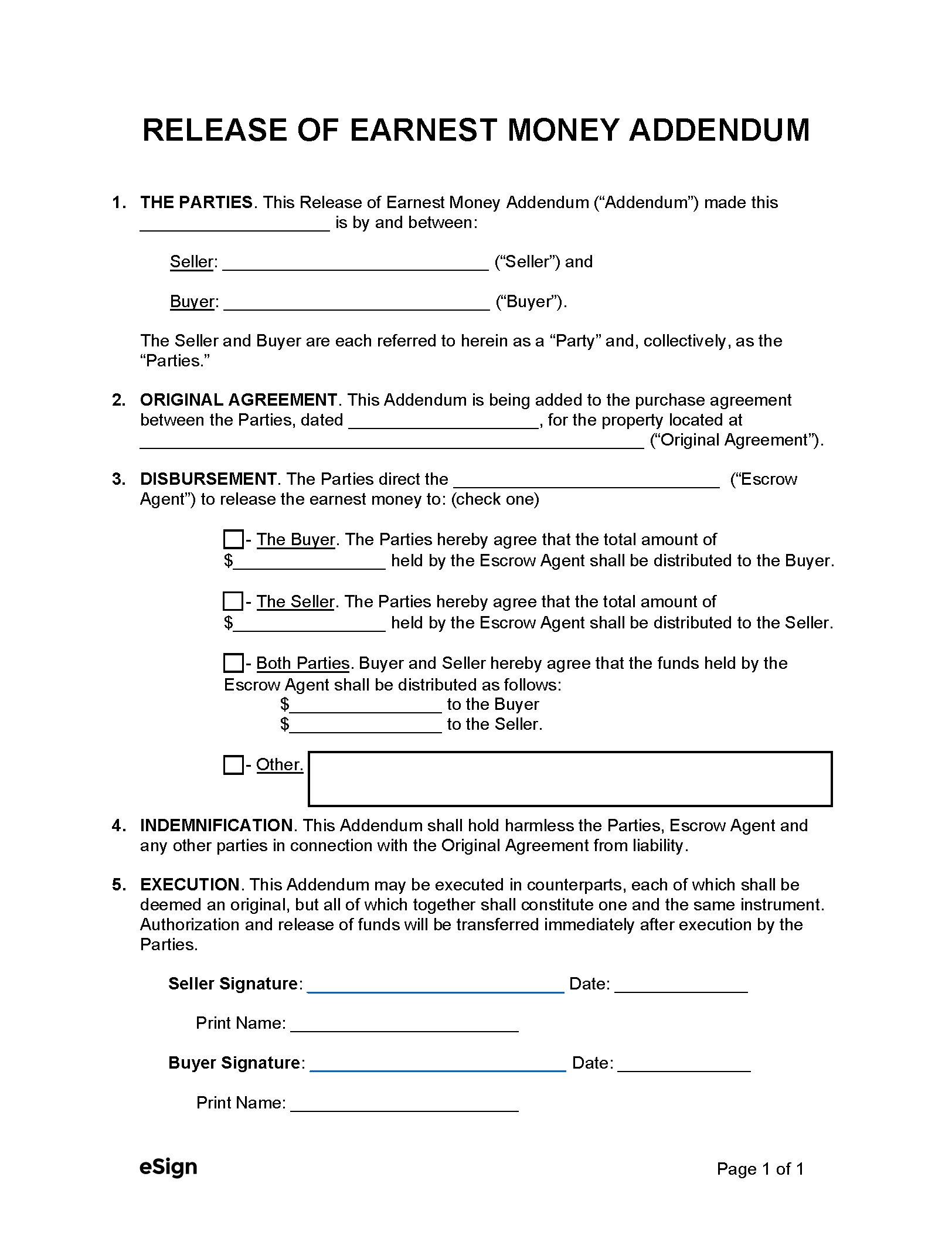

Well, let me tell you about this release of earnest money addendum thing. It’s like when you’re buyin’ a pig at the market, you gotta put some money down to show you’re serious, right? That’s what they call “earnest money.” This here paper, this addendum, it’s just somethin’ that says what happens to that money if the deal goes south.

Now, I heard from my neighbor, she was sellin’ her old cow, Bessy. She said sometimes these fancy city folk, they want that earnest money released to them soon as they can get it. They call these contingency things being satisfied. It’s like sayin’, “Okay, the pig’s got all its legs, and it ain’t sick, so give me my money now.” Seller, he likes it, ’cause if the buyer backs out, seller get the money, no problem.

See, if that buyer, he just ups and changes his mind, poof! That earnest money, it goes straight to the seller. That’s just how it is. Like when you promise to buy a dozen eggs and then say, “Nah, I don’t want ’em anymore.” You lose your deposit. It’s only fair.

But, if there’s a good reason, like maybe the buyer can’t get the money from the bank, they call that a “Buyer Contingency” not met, then the buyer, he gets his money back. Or, maybe the house got some problems found, like termites or somethin’. Then the money goes back to the buyer, too. That’s like findin’ out that pig you were gonna buy has the mange. You wouldn’t want it then, would ya?

Now, the fella that’s holdin’ onto this earnest money, they call him an “escrow agent.” He’s like the guy at the fair who holds your money while you’re tryin’ to win that big stuffed bear. He just keeps it safe in a special place, what they call an “escrow account.” Once that money goes in there, it’s like puttin’ it in a locked box.

- If the buyer walks away for no good reason, seller keeps the earnest money.

- If the buyer can’t buy because of those “contingency” things, the buyer gets the money back.

- The escrow agent just holds the money safe until everyone figures out what’s what.

This paper, the release of earnest money addendum, it just spells all this out. It’s got all them fancy words, like “parties” and “termination.” But really, it just means who gets the money if the deal is off. Plain and simple. There is form named TAR 1904 that has the word to release everyone from the contract.

Paragraph 18.C talks about how to release the earnest money. And “DEMAND” means ask for the money when the contract is over.

They got another paper too, I think it’s called a “Release of Earnest Money Form.” That one’s for when everyone agrees to just walk away from the whole thing. Seller and buyer, they both sign it, and it’s like sayin’, “Okay, we’re done here.”

This whole earnest money release thing, it’s important, you see. It makes sure everyone knows what’s gonna happen to that money if somethin’ goes wrong. ‘Cause nobody wants to lose their hard-earned cash, not the buyer, not the seller, not nobody. If people have different ideas about the earnest money, then it will be a big problem.

And you have to sign some paper to say that the earnest money has been released from some place. That’s what the earnest money release is.

So, if you’re ever buyin’ or sellin’ somethin’ big, like a house or a piece of land, you make sure you understand this earnest money business. It’ll save you a whole heap of trouble later on. You don’t want no surprises when it comes to your money, now do ya? Just like you wouldn’t want to buy a pig in a poke. You gotta know what you’re gettin’ into.

This release of earnest money addendum, it might seem all complicated with its fancy words, but it’s really just common sense. Just remember what I told ya, and you’ll be alright.

And always have this earnest money addendum to make sure everyone knows who will get the money.