Well, now, if you’re lookin’ to figure out how to get your money outta that OneAmerica retirement account when you’re switchin’ employers, it ain’t as hard as some folks might think. I know it can feel a bit confusing, but I’ll walk ya through it step by step, nice and easy.

First thing’s first, when you leave a job, whether it’s ’cause you found a new gig or just retired, you got options for what to do with that money you been tuckin’ away in that 401(k) or whatever retirement plan you got. Don’t just let it sit there—better to take it with you than leave it hangin’ around.

So, what can you do with it?

Well, you got a few choices, but I’ll break it down so it don’t get all muddled up. You can either:

- Cash it out – If you need the money right now, you can take it all out and spend it. But I gotta warn ya, that ain’t the best option if you ask me. You might end up payin’ a lotta taxes and penalties on that money, especially if you’re under 59 and a half years old. Don’t let that surprise ya!

- Roll it over to a new plan – If you’re movin’ to a new job and they offer a retirement plan, you can roll over that money right into the new plan. That means your money keeps workin’ for ya, and you ain’t gotta deal with any of them pesky taxes until you take it out later on down the road.

- Move it to an IRA – If you don’t wanna mess with your new job’s retirement plan, you can roll it over into an IRA (Individual Retirement Account). It’s just a fancy way of sayin’ you got a personal account for your retirement savings, and it can give you more flexibility with your investments.

- Leave it with your old employer’s plan – Some folks just leave their money in the old 401(k) plan if they ain’t ready to deal with it yet. But sometimes, that don’t give you the best options for growin’ your money.

Now, whichever option you choose, you’re gonna have to get in touch with the folks at OneAmerica to make sure you get everything done right. I ain’t sayin’ it’s hard, but there’s some paperwork you gotta fill out, and you might need to send it in the mail.

How to start the process

First off, you’ll need to contact OneAmerica to let ‘em know you’re movin’ your money. You might gotta fill out a form—don’t worry, they’ll have one for ya. Once you got the form, you’ll either mail it to ’em or do it online, depending on what they tell ya. If you’re like me and don’t trust all them computers, you can do it the old-fashioned way with a pen and paper.

Now, if you’re unsure how to go about it, don’t be shy—call up OneAmerica and ask ’em. They got folks who’ll walk ya through it. You might even find you can do it over the phone, if that suits ya better.

What happens after you request the transfer?

Once you get everything in order, the transfer might take a little time. It don’t happen overnight, so you might have to wait a week or two. Ain’t no need to worry though, your money’ll be safe while they’re makin’ sure it gets to the right place.

When it’s all said and done, you’ll get a notice sayin’ that everything’s been transferred, and then your money’s ready to start workin’ again in your new plan or IRA. Ain’t that somethin’?

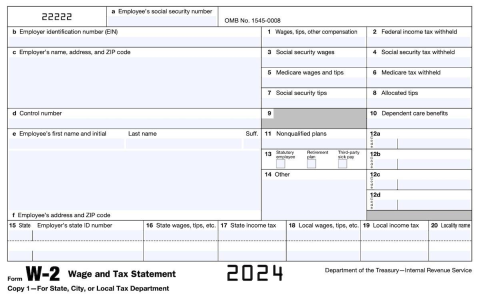

Don’t forget about taxes!

Now, I ain’t tryin’ to scare ya, but when you move that money around, you gotta keep taxes in mind. If you just cash it out, like I said earlier, they’ll probably take a good chunk outta it for taxes and penalties. But if you roll it over into a new retirement plan or IRA, you usually won’t pay taxes right then. You’ll pay ’em when you start takin’ the money out later in life, but that’s somethin’ to think about too.

And another thing—if you’re switchin’ employers, you might want to talk to a financial advisor. They’ll help you figure out the best way to manage your retirement money, and it could save you a heap of trouble down the road.

What else ya need to know?

If you’re lookin’ to move your health savings account (HSA) or any other savings, it works the same way. You just gotta get in touch with the folks at the old place and tell ‘em you wanna transfer it. Some of ’em let ya do it online, and some might want you to fill out a paper form. But either way, don’t put it off. It’s always better to take care of that stuff sooner than later.

So, there ya have it. It ain’t all that complicated once you break it down. Just make sure you understand all the steps, ask the right questions, and make sure you’re not payin’ too much in taxes or penalties. It’s your money, and you worked hard for it—make sure it’s workin’ for you when you move on to your next job or retirement!

Tags:[OneAmerica, retirement, 401(k), rollover, IRA, transfer, taxes, employer change, health savings account, financial advice]