Well now, if you’re lookin’ for a way to make your money work for you, you might’ve heard of this thing called the “Money 6x Investment Trusts.” Sounds fancy, don’t it? But don’t you worry, I’ll break it down real simple for ya. This ain’t no magic trick, it’s just a way to invest your money and hopefully get a nice little return after a few years. So, sit back and let me tell ya what I know.

First thing’s first, you gotta understand what an investment trust is. Now, these here investment trusts are a bit like a big ol’ piggy bank, but instead of just collectin’ pennies, they hold a bunch of different kinds of investments—stocks, bonds, real estate, and other things like that. And the best part? You don’t have to go around pickin’ out individual stocks and bonds yourself. These trusts do all that for you, which makes things a whole lot easier.

Now, what makes the Money 6x Investment Trusts different from regular ones is that they use what they call “leverage.” That’s a fancy way of sayin’ they borrow money to invest more than they actually have. You see, they’re workin’ with six times the money they actually got! That’s why they call it 6x. It’s like you’re throwin’ a big ol’ party, and instead of just bringin’ a few folks, you borrow a bunch of extra chairs and snacks to make sure everybody’s happy. But remember, borrowin’ money can be risky. If the investments go south, well, it could hurt more than usual.

So, when you’re thinkin’ about puttin’ your hard-earned money into one of these trusts, it’s important to know that things can go up, but they can also go down. Ain’t no guarantee you’re gonna make a bunch of money right away. It’s a long-term game, and the longer you let your money sit in there, the better chance you got of seein’ it grow. That’s the key—patience.

Now, let’s talk a bit about how they work. These Money 6x Investment Trusts invest in a mix of things—stocks, bonds, and sometimes even a little bit of real estate. They’re diversified, which means they don’t put all their eggs in one basket. So if one thing goes bad, you might still have some other things doin’ alright. It’s like plantin’ a garden with a bunch of different crops. Even if the tomatoes don’t do well, maybe the beans will!

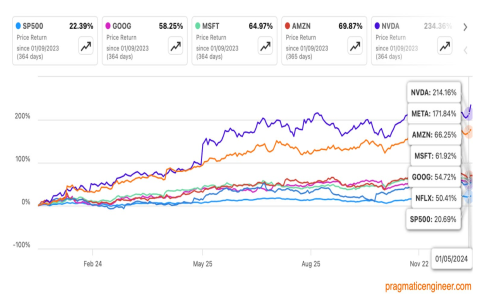

But don’t get too comfortable, ‘cause like I said, these trusts can be a bit more volatile. That means the value of your investments can swing around a lot more than in other types of funds. You could see a nice little gain one year, then the next, well, it might take a hit. So, it’s good to have a steady hand and a long-term outlook if you decide to get in on these.

One thing that’s good about these 6x investment trusts is they offer the chance for regular folks like you and me to get involved in investments that we might not be able to afford on our own. By borrowin’ that extra money, these trusts can afford to invest in bigger deals, and as a result, they’ve got the potential for better returns. But, like any investment, there’s always some risk involved. You’ve got to be prepared for the ups and downs.

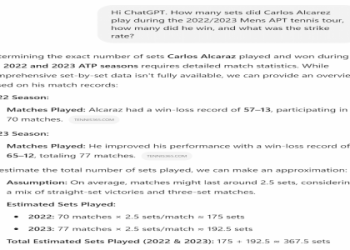

Some folks say that a 6% return on your money is a good target to aim for, especially if you’ve got at least 10 years before you plan on retirin’. That’s the rule of thumb, anyhow. But let me tell ya, you gotta do your homework and make sure you’re comfortable with what you’re investin’ in. Don’t go puttin’ your money into something just ‘cause it sounds good on paper. Research, research, research! Don’t just take my word for it, either. Make sure you talk to someone who knows a thing or two about this stuff, maybe a financial advisor.

If you’re thinkin’ about jumpin’ into these trusts, it’s important to remember that you’ll probably need a tax-advantaged account like a 401(k) or an IRA. That way, you won’t have to worry about gettin’ hit with all them taxes when your money starts growin’. Trust me, taxes can take a big ol’ bite outta your gains if you’re not careful.

So, if you’re lookin’ for a way to grow your wealth over time, this Money 6x Investment Trust might be somethin’ worth considerin’. It’s got the potential to give you a decent return, but you gotta know what you’re doin’ and be ready to ride out the ups and downs. It’s a long haul, but if you stick with it and keep your head on straight, it might just pay off in the end. And don’t forget, a little patience never hurt anyone!

- Investing in diversified portfolios

- Patience is key for long-term growth

- Be prepared for some ups and downs

- Consider using tax-advantaged accounts like IRAs or 401(k)s

- Leverage adds potential, but also risk

Alright, now I’ve said my piece. I hope this helps you understand a little more about the Money 6x Investment Trusts. Remember, it ain’t all smooth sailin’, but with some careful thought, it might be a good way to let your money grow. Good luck!

Tags:[investment, 6x investment trusts, diversification, long-term growth, stocks, bonds, real estate, tax-advantaged accounts, risk management]