Alright, let’s talk about this “money guy wealth multiplier” thing. I heard about it from my neighbor’s kid, he’s always fiddlin’ with his phone, talkin’ ’bout money and stuff. Sounds fancy, but lemme tell ya, it ain’t rocket science. It’s just about makin’ your money work for ya, like plantin’ a seed and watchin’ it grow.

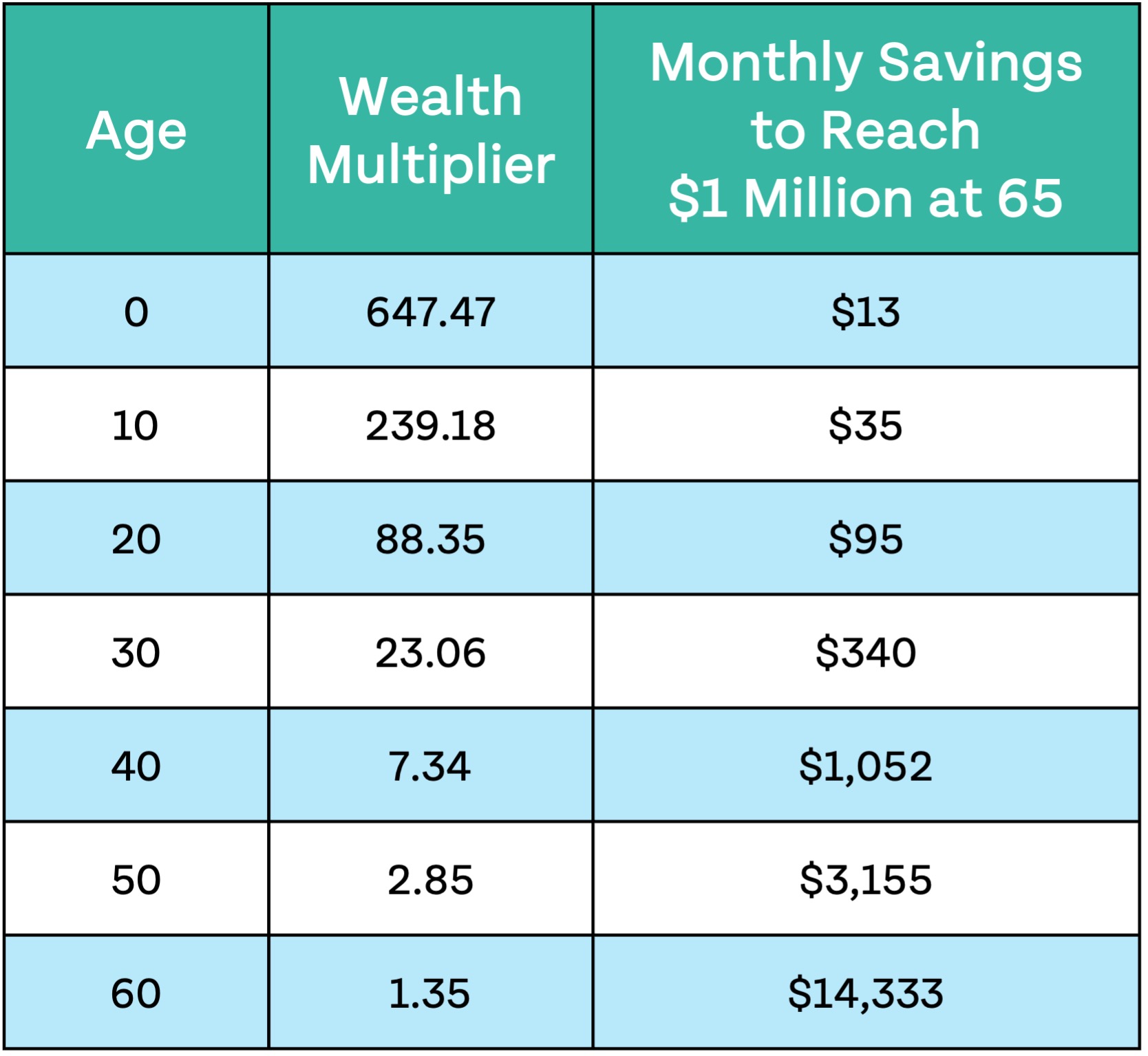

So, this “wealth multiplier,” from what I gather, it’s like a way to see how much money you can make if you start savin’ early. They say the earlier the better, and that makes sense. Kinda like plantin’ corn in the spring, the sooner you do it, the bigger your harvest.

What’s This “Wealth Multiplier” All About?

Well, it seems like this “money guy” fella, he’s got this tool, a calculator or somethin’, that shows ya how much your money can grow over time. You punch in your age, how much you’ve saved already, and it tells ya how much more you gotta save to get rich, like a millionaire, they say.

- You tell it how old you are.

- You tell it how much money you already got saved up.

- It tells you how much you gotta save every month to hit your goals.

Sounds simple enough, right? It’s like figuring out how many eggs you need to collect each day to have enough for a big family breakfast.

Start Early, That’s What They Say

They keep harpin’ on about startin’ early. And it’s true, I reckon. When I was young, we didn’t have all this fancy talk about “investing.” We just worked hard and saved what we could. But if I had known then what I know now, maybe I woulda done things a bit different. Maybe I woulda put a little bit of money aside every month, even if it was just a few dollars.

This “money guy” and his “wealth multiplier”, they’re sayin’ the same thing, just with fancy words. They’re sayin’ if you start savin’ when you’re young, even a little bit, it can grow into a whole lot over time. It’s like compound interest, they call it. Sounds complicated, but it just means your money makes more money, and that money makes even more money. It’s like when you have a hen that lays eggs, and then those eggs hatch into more hens that lay even more eggs.

You Don’t Gotta Be Rich to Start

The good thing is, they say you don’t gotta be rich to start. You don’t gotta be born with a silver spoon in your mouth, as they say. Even if you just put a little bit aside each month, it can add up over time. It’s like savin’ your pennies in a jar, eventually you’ll have enough for somethin’ nice.

Gamifyin’ Your Savings

They say this “wealth multiplier” thing, it “gamifies” savin’. That’s just a fancy way of sayin’ it makes it fun, like a game. You set a goal, like becomin’ a millionaire, and then you see how much you gotta save each month to get there. It’s kinda like when you’re quiltin’, and you set a goal to finish a certain number of squares each day.

Ownin’ Your Time

And this talk about “ownin’ your time”… that sounds pretty good. Means you don’t gotta work your fingers to the bone ’til you drop. You can retire early, they say, and do what you wanna do. Spend time with your grandkids, travel, or just sit on the porch and watch the world go by. That’s the dream, ain’t it?

It Ain’t Magic, It’s Just Savin’ Smart

So, this “money guy wealth multiplier,” it ain’t magic. It’s just a way to see how much your money can grow if you save smart and start early. It’s about makin’ your money work for you, instead of you workin’ for your money. It’s about plantin’ those seeds early and watchin’ ’em grow into a big ol’ money tree.

Final Thoughts

Look, I ain’t no financial expert. I’m just an old woman who’s seen a thing or two. But I can tell you this: savin’ money is important. And if this “money guy” and his “wealth multiplier” can help folks save more and retire early, then I say, more power to ’em. Just remember to keep it simple, start early, and don’t be afraid to ask for help if you need it. And don’t go spendin’ all your money on fancy gadgets, like my neighbor’s kid. Just sayin’.

Keywords: money guy wealth multiplier, wealth multiplier, save money, retire early, start saving early, investments, financial planning, become a millionaire, gamify investing, compound interest.