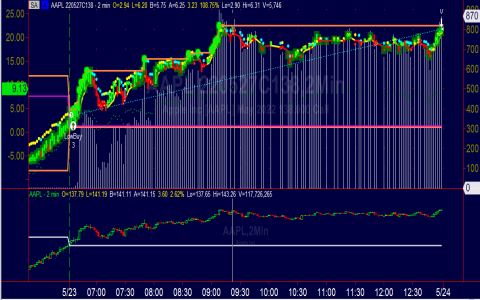

That darn NVDA stock, it’s been somethin’ else, ain’t it? Now, I heard some folks talkin’ ’bout this thing called “covered call options,” and how to set out of money with it. I ain’t no fancy Wall Street type, but I figured I’d try to make sense of it, best I can.

Covered Call Options? What in Tarnation?

Well, from what I gather, these “covered calls” are like sellin’ a promise. You got some NVDA shares, right? And you say to someone, “Hey, I’ll sell you these shares at a certain price, later on.” They give you some money upfront, like a down payment, for that promise. That’s the “premium,” they call it. I call it money in my pocket. This is how to make money from options, I think.

Now, this “certain price” is called the “strike price.” It’s higher than what the stock’s worth now. Why would someone buy that promise? Well, they’re bettin’ that NVDA is gonna go way up, past that strike price. If it does, they can buy your shares at that lower price and make a profit. But if it don’t, you keep their money and your shares. Sounds like a good deal to me, long as NVDA doesn’t go shootin’ up like a rocket, then maybe you could sell it for more. I heard someone say “Nvidia covered call strategy” and that’s what it is, I think.

Pickin’ the Right Strike Price

Now, how do you pick that strike price? That’s where this “out of the money” part comes in. It just means you pick a price that’s higher than what NVDA is sellin’ for now. The further out of the money, the less likely it is that NVDA will reach that price. And the less money you get upfront. But, it’s safer, see? Less chance of havin’ to sell your shares.

- If NVDA is at $100, you might pick $110, $120, or even higher.

- Higher strike price means less money now, but more chance of keepin’ your shares.

- Lower strike price means more money now, but more chance of sellin’ your shares.

It’s like bettin’ on the weather. You can bet it’ll rain tomorrow, and you might get a little money if it does. Or you can bet it’ll snow in July, and you’ll probably keep your money, ’cause that ain’t likely to happen. I heard some smart-talkin’ fella mention something called implied volatility. Don’t ask me what it means, but it is something about how much money you can get, I think.

Why NVDA?

Why are we even talkin’ ’bout NVDA? Well, that company, they make those computer chips, right? The ones for them video games and such. And they’re doin’ real good, from what I hear. Stock’s been goin’ up and up. So, people are bettin’ it’ll keep goin’ up. That’s why these covered calls are a thing with NVDA.

NVDA covered call is a good way to make some money. But also, people like me have to be careful. If you are not careful, you may lose all your money, not just your NVDA stocks.

How Much Money Can You Make?

Well, that depends. Depends on the strike price you pick, how long until the promise expires, and how much NVDA is movin’ around. But I seen some numbers, and it can be a decent chunk of change. Enough to buy a new tractor, maybe, or at least a good used one.

Let’s say you got 100 shares of NVDA. And you sell a covered call with a strike price of $150, and it expires in a few months. You might get, say, $5 per share for that promise. That’s $500 right there! Not bad for just waitin’ around. Of course, if NVDA goes above $150, you gotta sell your shares. Then, you miss the chance of getting more if it goes to, say, $160. But you still got that $500, plus the $150 per share when you sold. That’s how to trade options for income, ain’t it?

And if you think stock covered call is good, you need to check the NVDA one. You may find it is much better.

Is It Risky?

Well, sure, there’s always some risk. Like I said, if NVDA goes way up, you might miss out on some profits. But you still make money, just not as much as you could have. And if NVDA goes down, well, you still keep that premium money. So it kinda cushions the blow a little.

It ain’t like gamblin’ at the casino, where you can lose everything. You still got your shares, even if they’re worth less. It’s more like sellin’ eggs at the market. You might not get the best price every time, but you still get somethin’ for your trouble.

I heard that covered call trading opportunities are a lot for NVDA. And they are high probability. I don’t know much about probability, but I know if you do it right, you can make some good money from it.

What’s the Catch?

There ain’t really a catch, but there are some things to keep in mind. You gotta have the shares to begin with, at least 100 of ’em. And you gotta be okay with sellin’ them if the price goes up. If you sell covered call options, you may have to sell your stock later. It is a thing you need to know. And you gotta pay some fees to the folks who help you do all this, the brokers and such.

So, Should You Do It?

Well, that’s up to you. I ain’t your mama, I can’t tell you what to do. But if you got some NVDA shares, and you’re lookin’ for a way to make a little extra money, it might be worth lookin’ into. Just remember what I said: pick a strike price that makes sense, don’t bet the farm, and be prepared to sell if you have to.

And don’t go thinkin’ this is gonna make you rich overnight. It’s more like plantin’ seeds and watchin’ ’em grow. Slow and steady, that’s the way. It’s not like them lottery tickets, where you either win big or lose everything. This is more like a sure thing, just not a huge thing. But you know, I heard someone say writing covered calls, I guess that is what we are doing, maybe.

Now, if you’ll excuse me, I gotta go check on my chickens. They ain’t gonna lay eggs if I don’t feed ’em. And that’s a sure thing, just like these covered calls, in a way.