Well, let me tell ya, Chapter 13 can really mess things up for ya, no matter how good you think you’re doin’ at the time. I know I wasn’t the only one who thought I had it all under control, but boy, was I wrong. Here’s my story, and I reckon it might help you if you’re thinkin’ ‘bout takin’ the same road.

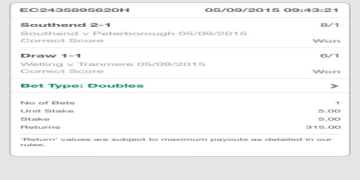

Back in June 2018, I found myself in a real pickle. Had around $60,000 in credit card debt, and even though I was makin’ around $75,000 a year, I didn’t qualify for Chapter 7. The courts told me I had to go with Chapter 13, which meant settin’ up a payment plan. They told me I’d be payin’ $1,020 a month for five years. It didn’t seem too bad at first, especially since I was livin’ in a nice apartment in Chicago and rent was cheap. I could manage that payment, I thought. But little did I know, that was just the start of my troubles.

First thing, that strict repayment plan? It’s no joke. It’s not like you can miss a payment or make a smaller one. You gotta pay what they say, no questions asked. Now, I thought, ‘Alright, I can do this,’ but it wasn’t long before I realized how much it was takin’ outta me. Every month, I had to squeeze every penny I had just to meet that $1,020. You can imagine how tough it got—had to cut back on groceries, stop doin’ the things I used to enjoy, just to make sure I didn’t fall behind. And don’t even get me started on what it did to my credit. Every time that payment was due, I’d get a reminder that my credit score was just takin’ a nosedive. Ain’t no way to sugarcoat that.

Why Chapter 13 Might Ruin Your Life

Now, I know folks will tell ya that Chapter 13 is the only way out when you’re deep in debt. They say it helps you save your house or car or whatever asset you’re tryin’ to hold on to. But lemme tell ya—what they don’t tell ya is how much it can cost ya in the long run. You might save your house, sure, but what good is that if you’re stuck in a payment plan for years and your credit is shot to pieces?

Here’s the thing—Chapter 13 can feel like a trap. You’re locked into that plan, and no matter how bad things get, you gotta keep goin’. You can’t just wave a magic wand and make your payments go away. If you’re already under a lotta stress, this just adds more weight to your shoulders. It can feel like you’ll never get outta it. And let’s not forget how bad it looks on your credit report. Even after you finish, it’ll stick there for years, hauntin’ ya like a bad dream. The average credit score after a Chapter 13 discharge is around 400 to 530—just enough to make it hard to get a loan for anything, even a used car.

How to Avoid Chapter 13 Ruinin’ Your Life

So, what can ya do to keep Chapter 13 from completely wreckin’ your life? Well, there’s a few things ya can try, but let me tell ya, none of ‘em are easy. First, you can try refinancing your home. If you’ve got a house, refinancing might help you pay off some of that debt without having to file for bankruptcy. It won’t be a walk in the park, but it might be worth a shot if you’re tryin’ to avoid that Chapter 13 trap.

Another option is to try settin’ up a debt consolidation plan. This can help you combine all your debts into one monthly payment, which might be lower than what you’re payin’ under Chapter 13. It’s not always the best option, but it can help ya catch your breath if you’re feelin’ like you’re drownin’ in payments.

And if ya do end up in Chapter 13 anyway, make sure you understand everythin’ about the plan before you sign on the dotted line. Talk to a lawyer, get all the info you can, and make sure you know exactly what you’re getting yourself into. Don’t just blindly accept what the court says—make sure it’s the right choice for you and your situation.

Should You File for Chapter 13?

Well, that’s a tough one. Chapter 13 is meant to help folks who are really in a bind, but it can feel like a nightmare if you’re not careful. If you’re thinkin’ ‘bout filing, make sure you understand the long-term consequences. Sure, it might save your house, but what’s the point of keepin’ your house if you can’t get a loan for a car or anything else for years? You might be stuck in a financial hole for a long time. There’s no easy answer, but it’s something you really gotta think about before takin’ that step.

Now, I’m not sayin’ Chapter 13 is the worst thing ever, but I’ll tell ya this—it wasn’t easy for me. And I wouldn’t wish it on anyone unless it’s the only way to save somethin’ important to ya, like your home. Just don’t think it’s a quick fix, ‘cause it’s far from it. It’s more like a long, hard road, and you better be ready for the ride.

Tags:[Chapter 13, bankruptcy, Chapter 13 bankruptcy, filing for bankruptcy, debt, financial advice, credit score, bankruptcy horror stories, financial troubles, bankruptcy repayment plan, Chapter 13 process]