Teaching time value of money (TVM) ain’t no easy job, I tell ya. This thing got all these numbers, future, present, and all that fancy math, but usin’ the right tools can make it a tad easier for teachers and students alike. Now, lemme give ya a few tips and tricks that’ll make this whole TVM thing a bit clearer, so the students can get a good grasp without all the fuss.

1. Start With Real Simple Examples

First off, you gotta start simple. Don’t just dive into numbers, make ‘em see why a dollar today is worth more than a dollar tomorrow. Just tell ’em straight: “If I give ya a dollar today, you could buy somethin’ right now. But if ya wait a year, prices go up, interest does its thing, and that dollar won’t be able to get ya the same stuff.” Start with somethin’ they know, like buyin’ candy or a soda.

Then ya build on that idea bit by bit. Use numbers they can manage, and maybe even act it out if ya can. They’ll understand this whole “money grows over time” idea without losin’ focus. By keepin’ it simple at first, ya make the next part, like calculations and all that, a lot easier.

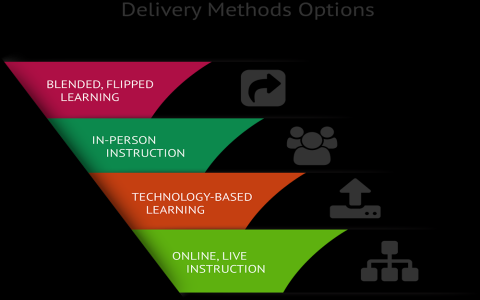

2. The Power of Visual Tools

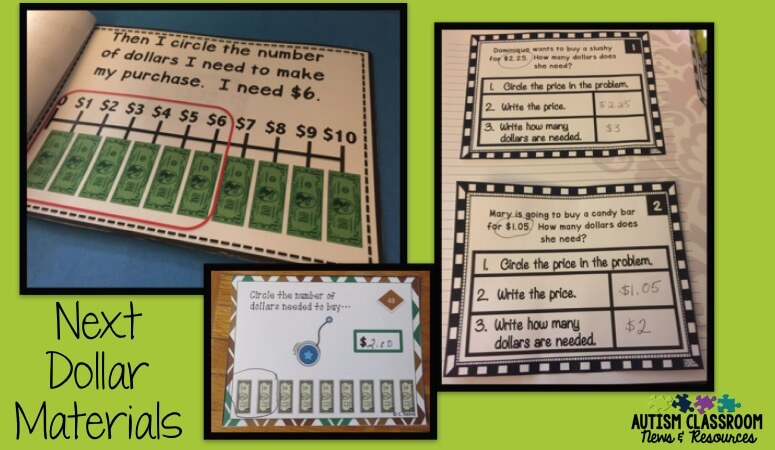

When it comes to learnin’ about time value, visual stuff can do wonders. Try usin’ charts or a big ol’ timeline. Put the money now on one end, future money on the other, and show how it grows with interest. There are plenty of tools online for makin’ these graphs – some folks use spreadsheets like Excel, or even online calculators that let ya plug in numbers and see how they grow over time. For example, an online tool or Excel’s FV function can show how $100 grows in 5 years at 5% interest. Just a little peek can make it all click for students.

And don’t forget about interactive tools! There’s stuff like Econ Lowdown that’s got materials made for high schoolers and beyond. They even got exercises that students can try themselves – so they can click around, change numbers, and see how it all works with their own eyes.

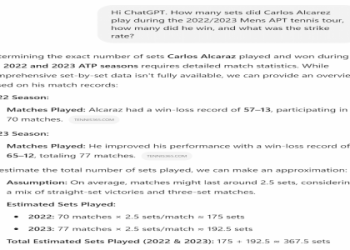

3. Exercises That Get ‘Em Thinking

Ya gotta keep ‘em involved, that’s for sure. Simple exercises go a long way in teachin’ TVM. Here’s an easy one ya can do in class:

- Tell the students: “Imagine I give ya $100 now or $110 next year. Which would ya pick?”

- Let ‘em think about it a bit – this gets ‘em wonderin’ about how that extra $10 works out over time.

- Then explain that the interest rate, that’s the key, and it’s how they decide if that $10 next year is worth more or less than the $100 now.

Exercises like this make ‘em think with their own heads. Then ya can talk about stuff like present value and future value. Tell ‘em how banks use these ideas every day, and it’s not just for math class – it’s somethin’ they’ll need to know about when they’re savin’ or borrowin’ money one day.

4. Teach ‘Em Discounting and Compounding Without Fancy Math

Now, don’t jump to formulas right away – that’s a surefire way to scare ‘em off. Instead, talk about how future money “shrinks” back to present money with discounting. Tell ‘em, “This discountin’ thing just means figurin’ out how much future money is worth today.” Keep it simple, like “Imagine ya got a jar, and every year it takes a little out of what ya’ll get later.”

Compounding is the opposite – it’s like adding more on top. Tell ‘em if ya leave money in the bank, it don’t just sit there; it grows each year, and it grows on what it grew last year too. It’s like growin’ plants: the more they grow, the bigger they get each season. Simple enough to picture, right?

5. Use Scenarios They Can Relate To

Best way to make TVM make sense is to tie it to real-life choices. Ya can give ‘em scenarios like: “If ya borrow $100, how much will ya pay back if the bank charges ya interest?” Or, for future planning: “How much do ya need to save each month if ya wanna buy a car in 5 years?” When students see how it connects to their own lives, they’ll be more interested and understand it better.

6. Wrap It Up With Group Work

To finish up, let ‘em try group work. Give ‘em a goal, like a pretend “retirement plan” or savin’ for somethin’ big, like college. They can figure out together how much to save now, what interest rate they’ll need, and see how their money grows. Workin’ as a team, they can bounce ideas off each other, and it helps ‘em learn faster. Plus, it’s less intimidatin’ when they’re all figurin’ it out together.

Final Words

So there ya go! Teachin’ the time value of money don’t have to be all fancy. Use simple words, pictures, and relatable examples. Keep ‘em engaged with hands-on stuff, and by the end, they’ll understand why a dollar today is worth more than a dollar tomorrow. Remember, the easier ya make it, the more they’ll get out of it. And that’s what matters most.

Tags:[Time Value of Money, Teaching Tools, Economics Education, High School Finance, Interest Rates]