Alright, let’s talk about this hard money non-QM stuff. I ain’t no fancy banker or nothin’, but I’ll tell ya what I know, the way I understand it.

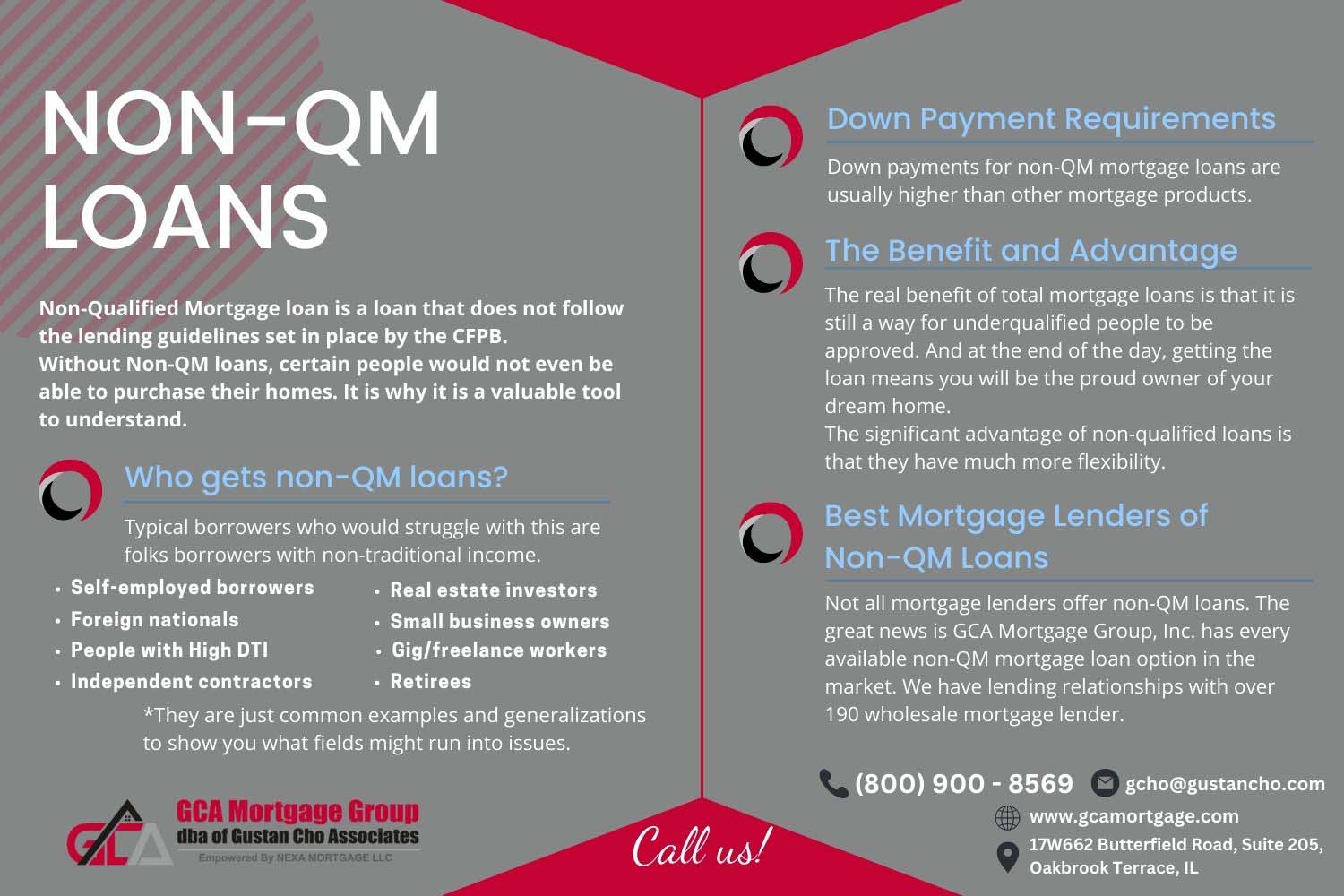

First off, this non-QM thing, that’s just a fancy way of sayin’ it ain’t your regular, run-of-the-mill loan. See, them big-shot government folks, they got all these rules ’bout who can get a loan and who can’t. Well, non-QM loans, they kinda bend them rules a bit. They for folks who might not fit in them neat little boxes the banks like.

Now, what’s a hard money loan then? Well, it’s like… it’s like borrowin’ money from a fella down the street, not some big ol’ bank. But this fella, he ain’t doin’ it outta the goodness of his heart, ya know? He wants his money back, and he wants it quick. And he charges ya a pretty penny for it.

So, why would anyone want a hard money non-QM loan? Well, sometimes you just need the money fast. Maybe you’re fixin’ up a house to sell, and you need some cash to get the work done. Banks, they take forever to give ya a loan, all that paperwork and whatnot. But a hard money lender, they can get you the money quick, sometimes in just a few days.

But here’s the catch. Hard money loans, they ain’t cheap. Them interest rates, they can be sky-high. And you gotta pay it back quick, usually in a year or two. So, it’s not somethin’ you wanna do unless you really gotta.

- Speed: Hard money loans are fast. If you need cash quick, this might be your only option.

- Flexibility: Non-QM loans are more flexible than regular bank loans. They’re more willing to work with folks who have unusual financial situations.

- Cost: Hard money loans are expensive. The interest rates are high, and you gotta pay it back quick. So be careful!

I heard some folks sayin’ that the difference in price between hard money and non-QM loans ain’t so big anymore. That means them hard money fellas are gettin’ a bit more competitive, which ain’t a bad thing, I reckon.

Now, some folks say hard money is like, real gold and silver, actual cash in your hand. But that ain’t what we’re talkin’ ’bout here. We’re talkin’ ’bout loans, money you borrow. And these hard money loans, they usually for short-term stuff, things you gotta get done quick. They kinda risky, ya know?

Non-QM loans, they better than hard money when it comes to how much you gotta pay back and how long you got to pay it. But they take longer to get. It’s like, you want it fast, you pay more. You want it cheaper, you gotta wait.

I tell ya, it’s like when you need eggs for a cake, you can go to the fancy store and pay more for the organic ones, that’s like your non-QM loan, better quality, takes a bit longer. Or you can go to your neighbor and get some eggs right away, but they gonna cost ya more, that’s your hard money, quick and easy, but you pay the price. It all depends on what you need and when you need it.

So, if you’re thinkin’ ’bout a hard money non-QM loan, make sure you know what you’re gettin’ into. Talk to some folks, do your research. Don’t just jump into somethin’ ’cause you’re in a hurry. And for goodness sake, read the fine print! Them loan papers, they can be tricky.

And remember, just like when you’re pickin’ tomatoes, you gotta check for the bad spots. Make sure you ain’t gettin’ ripped off. There’s always someone tryin’ to pull a fast one, ya know?

In the end, it’s all about figurin’ out what’s best for you and your situation. Ain’t no one-size-fits-all answer. Just use your common sense, and don’t be afraid to ask questions. And if somethin’ sounds too good to be true, well, it probably is.

Tags: Hard Money, Non-QM, Loans, Financing, Mortgage, Real Estate, Borrowing