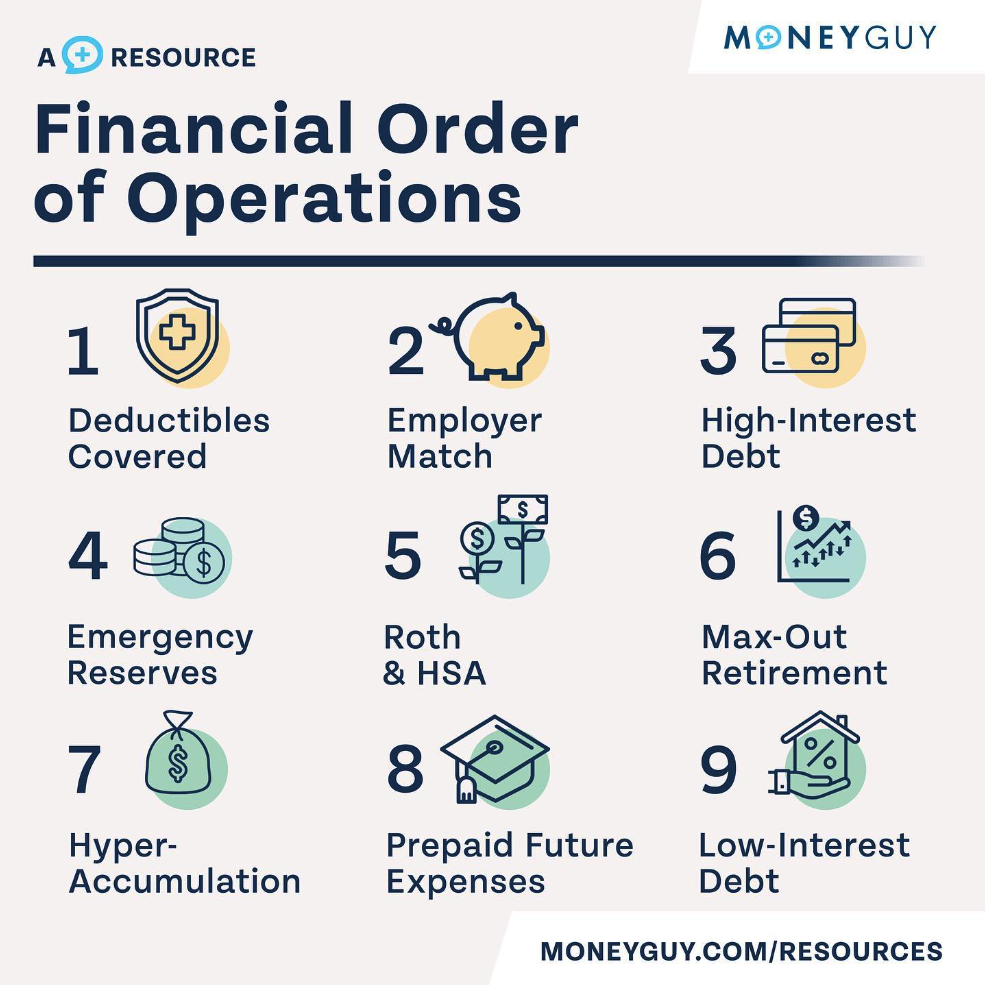

Okay, so I finally tackled the “Money Guy Order of Operations” thing. Heard a lot about it, seemed kinda basic, but you know, sometimes the basics are what you’re missing, right?

First thing I did was actually find the damn thing online. It’s all over YouTube and blogs, but I wanted the original. Found it on some financial planning website, a simple numbered list. Printed that sucker out, because I’m old school like that.

Step one, like always, was budgeting. Groan. I hate budgeting. But I opened up my bank statements, stared at the numbers until my eyes glazed over, and finally hammered out a realistic budget. Used some free app I found, Mint maybe? Something like that. Point is, I actually tracked where my money was going for a whole month. Painful, but necessary.

Next up was emergency fund. I had… some money saved. Not enough. The goal was 3-6 months of living expenses. So, I figured out what my absolute bare minimum monthly expenses were (rent, food, utilities), multiplied that by six, and stared at the horrifying number. Okay, goal set. Started aggressively cutting back on stuff – no more eating out, brewed my own coffee (bleh), canceled some subscriptions I wasn’t using. Every extra penny went into a high-yield savings account.

Then came the debt. I had some credit card debt lingering from… well, from being irresponsible in my younger days. Highest interest rate first, that’s the rule. So, I threw everything I could at that one card. Used the “snowball” method – even if other debts had lower minimum payments, I focused on getting that high-interest one GONE. Felt SO good when I finally paid it off.

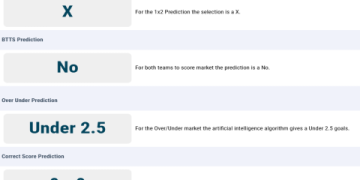

After that, it was all about investing. This is where I got a little stuck. I’d always been intimidated by investing. So, I did some research. Read some books, watched some videos, talked to a friend who knows their stuff. Decided to start small, with a Roth IRA. Maxed it out for the year. Scary, but felt like the right thing to do.

Then mortgage. Luckily, I don’t have one right now. But the order says to put 15% down if I buy, and get a 15-year fixed rate. Good to know for the future. I guess this step was more about planning.

Finally, college savings. Again, not applicable to me right now, no kids. But I looked into 529 plans, just to educate myself. Good information to have for the future, in case I decide to have a family someday, or want to help out nieces and nephews.

So, the Result?

- Budget: Actually have one now, and I’m sticking to it (mostly).

- Emergency Fund: Getting there. Still a work in progress, but making steady progress.

- Debt: Credit card debt GONE. Feels amazing.

- Investing: Finally started! Small steps, but I’m in the game.

- Mortgage/College: Planned for the future.

Overall, the “Money Guy Order of Operations” wasn’t rocket science. It was just a solid, step-by-step plan to get my finances in order. It forced me to face some uncomfortable truths about my spending habits, but it also gave me a clear path forward. Would recommend it to anyone who’s feeling lost or overwhelmed with their money. Just gotta actually DO it, you know?