Alright, folks, let’s talk about something that’s been bugging me for a while now: figuring out this whole money puzzle. You know, it’s like, one day you’re feeling flush, the next you’re wondering where all your dough went. It’s a wild ride, and honestly, I was pretty clueless about how to get a grip on it. So, I started digging around, trying to find some simple tips and tricks to make sense of my spending and saving habits.

First off, I decided to track every single penny I spent. Yeah, it sounds like a total drag, but trust me, it’s eye-opening. I just used a simple notes app on my phone, nothing fancy. Every coffee, every bus ticket, every impulse buy online – it all went in there. After a few weeks, I started to see some patterns. Like, wow, I spend way too much on eating out. Who knew?

- Tracking expenses: This was a game-changer. Seriously, it’s like shining a light on your spending habits.

- Spotting patterns: Once you see where your money goes, you can start to figure out where to cut back.

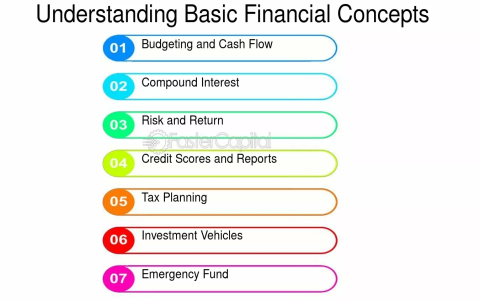

- Making a budget: I know, “budget” sounds like a dirty word, but it’s actually pretty liberating. I tried the 50/30/20 thing for a while, where you spend 50% on needs, 30% on wants, and 20% on savings. It didn’t totally work for me, but it was a good starting point. Now i tried the 75/15/10 rule, 75% of your income to needs such as everyday expenses, it’s work fine for me.

Then I started thinking about saving. I used to think saving was just for, like, rich people or something. But then I realized that even putting aside a little bit each week can make a big difference over time. I set up a separate savings account and started automatically transferring a small amount from my checking account each week. It’s like, out of sight, out of mind. And let me tell you, watching that little nest egg grow is surprisingly satisfying.

My Key Takeaways

Honestly, it’s not rocket science. It’s just about paying attention to where your money goes and making some small changes. And it’s not about being super strict or depriving yourself of everything. It’s about finding a balance that works for you. Like, I still treat myself to a nice dinner every now and then, but I’m more mindful about it. And the best part? I’m not constantly stressing about money anymore. It’s like a weight has been lifted off my shoulders. And if I can do it, trust me, anyone can. It’s all about taking those small steps and sticking with it. You got this!