Listen up, y’all, let’s talk about this money guy foo thing, whatever that means. Folks keep jabberin’ ‘bout gettin’ rich, but it ain’t as easy as pickin’ apples, lemme tell ya.

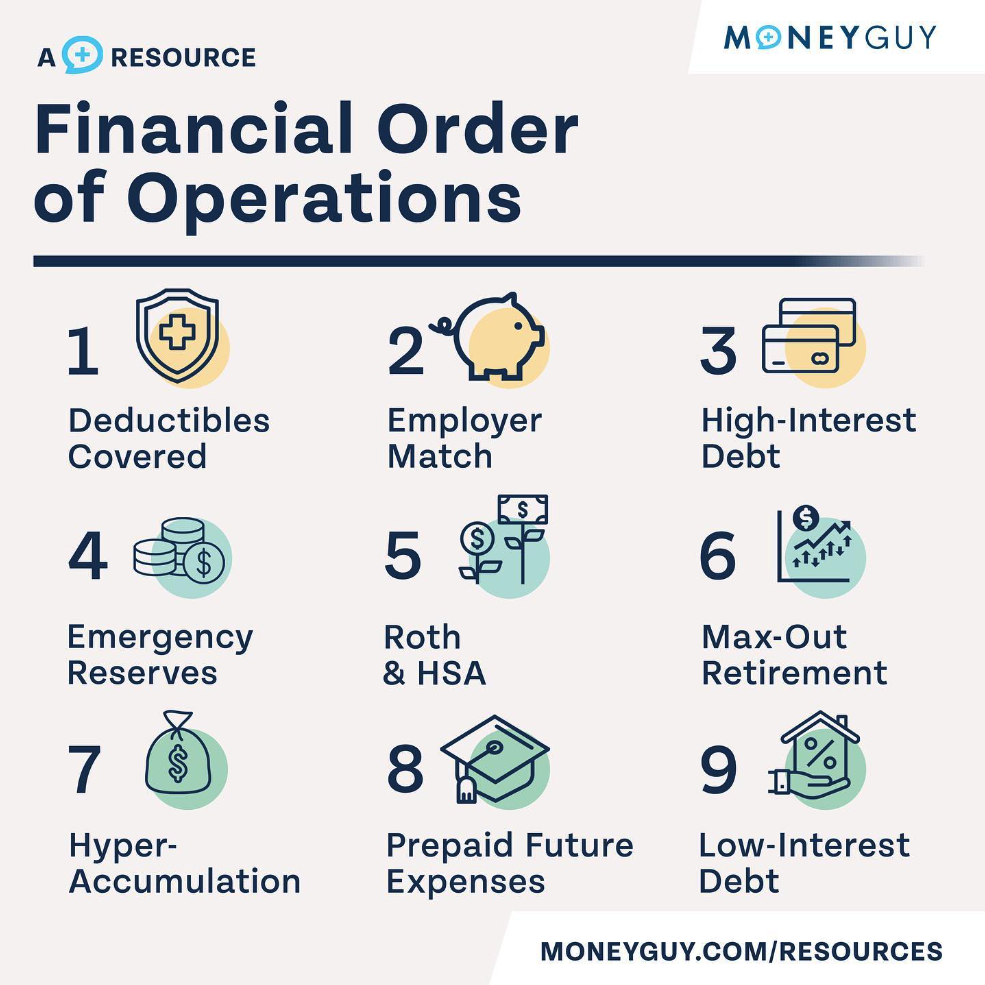

First off, they say you gotta save some money. Now, I ain’t talkin’ ‘bout hidin’ it under the mattress like old Ma Johnson used to do. They got these fancy things called 401ks and Roth IRAs. Sounds like a bunch of gibberish to me, but they say it’s for when you get old and can’t work no more. Like I ain’t old enough already, hah! Anyway, they say you should put some money in these things, maybe like a quarter of what you make. That’s a lot, I tell ya, but they say it grows like weeds if you leave it alone.

Then there’s this HSA thing. Heck if I know what that is, but it’s somethin’ to do with health, I reckon. They say it saves you money on doctor bills. Well, back in my day, we just used dandelion tea and a good night’s sleep, but times have changed, I guess.

So, you got your 401k, your Roth thingy, and this HSA, and they say you gotta put as much money in ‘em as you can. They call it “maxing out.” Sounds like somethin’ you do with a credit card, but they say it’s good for you. They say if you do this, you might even become a “millionaire.” Now that’s a fancy word, ain’t it? Means you got a whole lotta money, more than you could ever spend, I reckon.

But hold on a minute, it ain’t all about savin’. They say you gotta have somethin’ called an “emergency fund.” That’s just a fancy way of sayin’ you need money for when things go wrong. Like when the roof leaks or the cow gets sick. They say you need enough money to live for three to six months without workin’. That’s a long time to be sittin’ on your behind, but I guess it makes sense. You never know when life’s gonna throw you a curveball.

- Save money: Put some in those 401k and Roth thingamajigs. A quarter of what you make, they say.

- Health stuff: Figure out that HSA thing, might save you some pennies on doctor bills.

- Max it out: Put as much money as you can in those accounts, they say it makes you rich.

- Emergency money: Save enough to live for a few months without workin’. Just in case.

Now, there’s this fella, Andrew somethin’-somethin’, they say he was a big shot a long time ago. He said somethin’ about gettin’ rich bein’ important. Well, I ain’t so sure about that. Money ain’t everything, ya know. It can’t buy you happiness or good health, that’s for sure.

But I guess if you wanna be one of these “millionaires,” you gotta listen to these money folks. They seem to know what they’re talkin’ about, even if half of it sounds like hogwash to me. Just remember to be smart with your money, don’t go spendin’ it all on fancy gadgets and such. And don’t forget to help out your neighbors, that’s more important than anythin’.

So that’s the deal with this money guy foo, as far as I can tell. Save your money, take care of your health, and have some money put aside for a rainy day. And don’t go gettin’ too big for your britches if you do happen to become a “millionaire.” Remember where you came from, and always be grateful for what you got.

Folks got all sorts of ways to keep track of their money these days, too. Some use them little computer things, others write it all down in a book. Me? I just keep it in my head. Ain’t failed me yet! But I guess if you’re dealin’ with all these 401ks and Roths, you might need somethin’ a little fancier. Just don’t go gettin’ too caught up in it all. Money’s just a tool, nothin’ more. Use it wisely, and don’t let it use you.

And one more thing, don’t be afraid to ask for help. There’s plenty of folks out there who know more about this stuff than I do. Find someone you trust and get their advice. Don’t just go blindly followin’ what some fella on the internet says. Use your common sense, and you’ll be just fine.

So, to sum it all up: save, be prepared for emergencies, and don’t get greedy. That’s the real secret to wealth, if you ask me. And don’t forget to enjoy life, money ain’t worth nothin’ if you ain’t happy.

Tags: [Personal Finance, Saving Money, Retirement Planning, Emergency Fund, Investing]