Okay, so, I’ve been thinking a lot about where to stash my cash lately. I mean, it’s not like I’m rolling in dough, but I do have some savings that I want to keep safe and, you know, maybe grow a little. So I did what anyone in my shoes would do. I started digging into this whole “savior bank” thing.

First, I googled around for like an hour, just to get a general sense of what’s out there. I typed in “best savings accounts” and “safe banks to put money in” and stuff like that. Man, there’s a lot of information, some of it seemed kind of complex, but there were some interesting names.

I came across a few names like “WealthSimple,” “Motive Financial,” and “EQ Bank.” They kept popping up, and they seemed to be popular choices. I also noticed that some places were talking about these “TFSA” and “FHSA” things. I had to do some quick reading on those – they’re like special savings accounts, tax-free savings account and first home savings account, right? I gotta be honest, some of it felt like a different language. I wrote down these names with a pen in my notebook.

Then I started comparing these accounts. Websites, man, they have these comparison tools where you can see all the interest rates and features side-by-side. It was kind of overwhelming, but I slowly started to understand the differences. Some had higher interest rates, some had no fees, some had better online banking – it was a lot to take in. I carefully compared the pros and cons of different banks and accounts based on my situation.

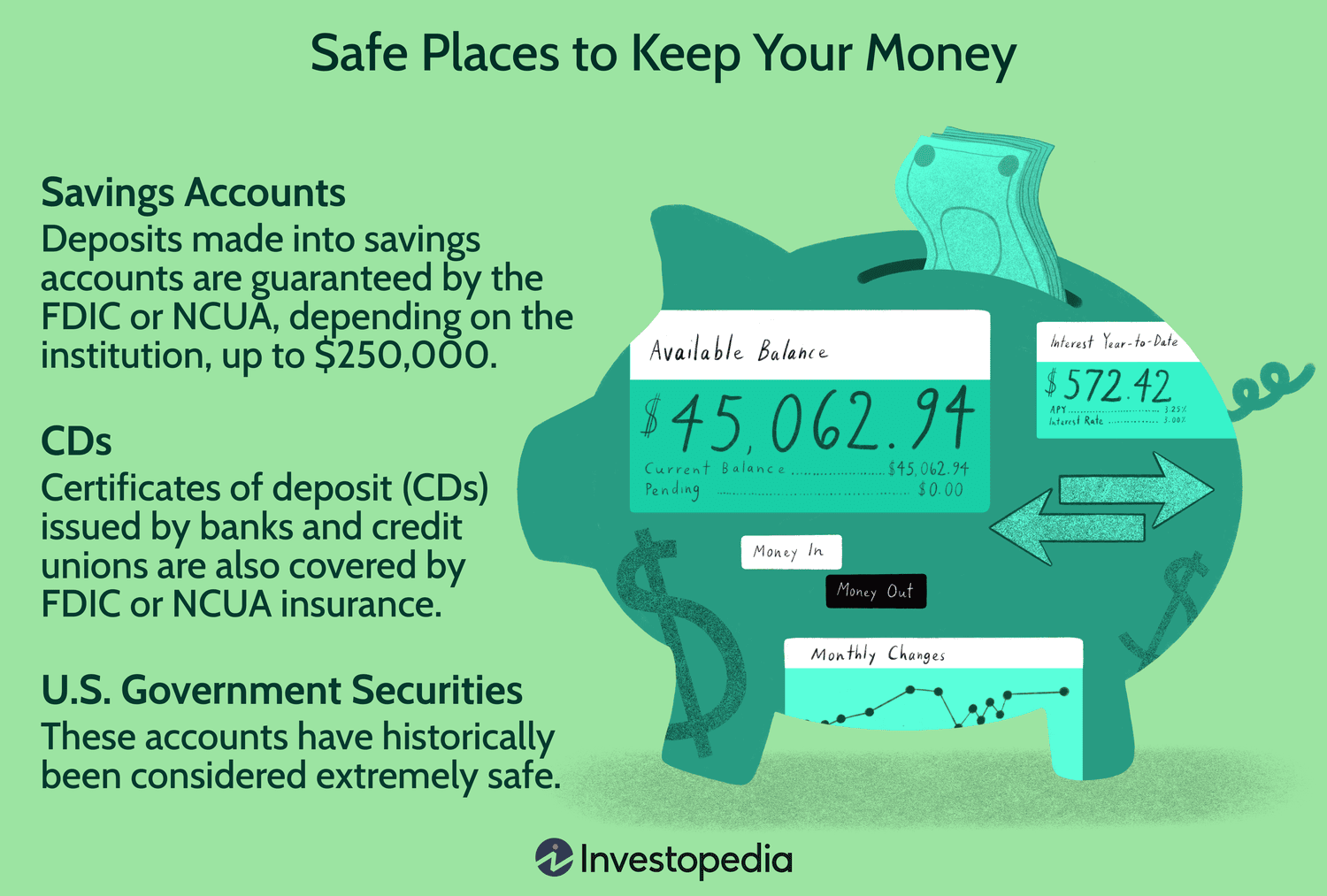

I also read a bunch of articles about, like, the basics of savings accounts. It was a good refresher. I mean, I know what a savings account is, but it helped to read about how they work and how they can help you reach your financial goals. I always thought a savings account was just a place to park your money, but some of these articles made me realize it could be more than that. I jotted down some notes about that, too.

I even looked into these big-shot private banks like J.P. Morgan and Citi. I figured, hey, maybe they have some secret sauce for keeping your money safe. I browsed their websites, looked at their savings options, but honestly, they seemed more geared towards people with way more money than me. I don’t think I’m quite at the “private bank” level yet, haha.

After all that, I narrowed it down to a few options that seemed like a good fit. I printed out some information about them and decided to sleep on it. I mean, it’s not a decision to make lightly, right? It’s your hard-earned money we’re talking about.

My Takeaway

- Choosing a bank isn’t easy. There are so many options, and each one has its own pros and cons.

- It’s important to do your research and compare different accounts before making a decision.

- Don’t be afraid to ask questions. I called a couple of banks to get more information, and they were pretty helpful.

- There are online banks which provide higher interest rate, and also traditional banks that you could just walk into and open an account.

- Think about your own financial situation and goals. What are you saving for? How much risk are you willing to take? How often do you need to access your money?

In the end, I opened a new saving account online with one of the banks I researched. I transferred most of my savings in there. I feel pretty good about it, and I’m excited to see my money grow. I know it’s not going to make me rich overnight, but it’s a step in the right direction. It was a lot of work, but I think I made a good choice. I’m just glad I took the time to figure it all out. Hopefully, this little adventure of mine helps someone else out there who’s trying to find the right place for their money!